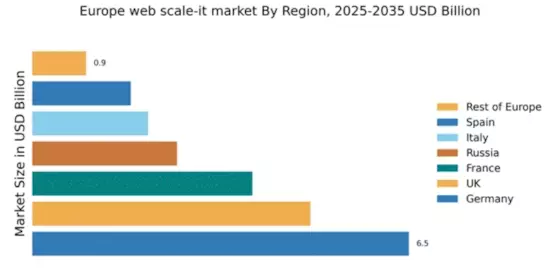

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding 6.5% market share in the European web scale-IT sector, driven by robust industrial growth and a strong emphasis on digital transformation. Key growth drivers include government initiatives promoting cloud adoption, significant investments in data centers, and a skilled workforce. The demand for scalable IT solutions is rising, particularly in sectors like automotive and manufacturing, where efficiency and innovation are paramount. Regulatory frameworks support data protection and cloud services, fostering a conducive environment for growth.

UK : Innovation and Investment Drive Demand

The UK boasts a 4.8% market share in the web scale-IT landscape, fueled by a vibrant tech ecosystem and increasing demand for cloud solutions. Key growth drivers include the rise of fintech and e-commerce sectors, which are rapidly adopting scalable IT services. Government policies promoting digital innovation and cybersecurity are also pivotal. The competitive landscape is characterized by a mix of local startups and established players, with London being a central hub for tech innovation and investment.

France : Strong Demand from Diverse Sectors

France captures a 3.8% share of the web scale-IT market, supported by a diverse economy and increasing digitalization across industries. Growth is driven by sectors such as retail, healthcare, and finance, which are increasingly leveraging cloud technologies for operational efficiency. Government initiatives like the 'France Num' plan aim to accelerate digital transformation among SMEs. Paris stands out as a key market, hosting major tech firms and startups, creating a competitive environment for cloud services.

Russia : Market Potential Amid Challenges

With a 2.5% market share, Russia's web scale-IT market is gradually expanding, driven by increasing digitalization and government support for IT infrastructure. Key growth drivers include the push for local data centers and compliance with data sovereignty laws. Major cities like Moscow and St. Petersburg are central to this growth, hosting significant tech companies and startups. However, the competitive landscape is challenging, with local players vying against international giants, creating a dynamic market environment.

Italy : Focus on Digital Transformation

Italy holds a 2.0% share in the web scale-IT market, with growth driven by the increasing adoption of cloud services across various sectors, including manufacturing and retail. Government initiatives aimed at enhancing digital infrastructure and promoting innovation are key growth factors. Major cities like Milan and Rome are pivotal markets, hosting numerous tech firms and startups. The competitive landscape features both local and international players, fostering a vibrant business environment for cloud solutions.

Spain : Investment in Digital Infrastructure

Spain's web scale-IT market, with a 1.7% share, is witnessing significant growth, driven by investments in digital infrastructure and increasing cloud adoption across sectors like tourism and finance. Government initiatives supporting digital transformation are crucial for market expansion. Key cities such as Barcelona and Madrid are central to this growth, hosting a mix of local startups and international tech firms. The competitive landscape is evolving, with a focus on innovation and customer-centric solutions.

Rest of Europe : Emerging Markets and Innovations

The Rest of Europe accounts for a 0.93% share in the web scale-IT market, with various emerging markets showing potential for growth. Key drivers include increasing digitalization and government support for IT initiatives. Countries like the Netherlands and the Nordics are notable for their advanced digital infrastructure and innovation. The competitive landscape features a mix of local and international players, creating opportunities for tailored cloud solutions across different sectors.