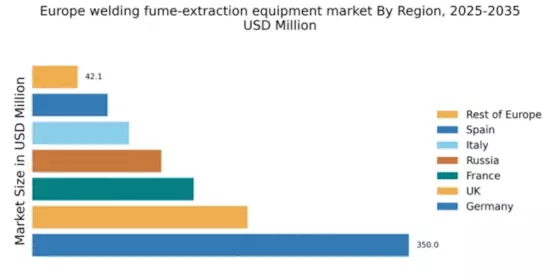

Germany : Strong Industrial Base Drives Demand

Key cities such as Berlin, Munich, and Stuttgart are pivotal markets, housing numerous manufacturing facilities. The competitive landscape features major players like Kemper and Bohler Welding, which have established strong local presences. The business environment is characterized by a focus on innovation and sustainability, with applications spanning automotive, aerospace, and metal fabrication industries.

UK : Regulatory Changes Boost Market Growth

Key markets include industrial hubs like Birmingham, Manchester, and London, where manufacturing and construction sectors are thriving. The competitive landscape features players like Lincoln Electric and Donaldson Company, which are well-positioned to meet local demand. The business environment is dynamic, with a focus on innovation and compliance with health and safety regulations, particularly in the automotive and construction industries.

France : Industrial Safety Regulations Drive Demand

Key cities such as Paris, Lyon, and Marseille are central to the market, with a strong presence of manufacturing and construction industries. The competitive landscape includes major players like ESAB and Kemper, which are actively expanding their offerings. The business environment is characterized by a focus on compliance with EU regulations and a growing trend towards automation in manufacturing processes.

Russia : Industrial Growth Fuels Equipment Demand

Key markets include Moscow, St. Petersburg, and Kazan, where industrial sectors are expanding rapidly. The competitive landscape features both local and international players, with companies like AER Control Systems gaining traction. The business environment is evolving, with a focus on investment in infrastructure and technology, particularly in the manufacturing and energy sectors.

Italy : Manufacturing Sector Drives Demand

Key cities such as Milan, Turin, and Bologna are significant markets, with a concentration of manufacturing and automotive industries. The competitive landscape includes players like Lincoln Electric and ESAB, which are well-established in the region. The business environment is characterized by a focus on innovation and compliance with EU regulations, particularly in the automotive and metalworking sectors.

Spain : Regulatory Focus Enhances Market Growth

Key markets include Barcelona, Madrid, and Valencia, where manufacturing and construction sectors are expanding. The competitive landscape features players like Donaldson Company and Fume Extraction Systems, which are actively addressing local needs. The business environment is dynamic, with a focus on compliance with health and safety regulations, particularly in the construction and manufacturing industries.

Rest of Europe : Varied Demand Across Sub-regions

Key markets include countries like Belgium, Netherlands, and Austria, each with unique industrial landscapes. The competitive landscape is fragmented, with both local and international players vying for market share. The business environment varies significantly, with a focus on compliance with local regulations and addressing sector-specific applications in manufacturing and construction.