Increased Cybersecurity Concerns

As the wireless connectivity market in Europe expands, so do concerns regarding cybersecurity. The rise in connected devices and the proliferation of data transmission heighten the risk of cyber threats. In response, businesses and consumers are increasingly prioritizing secure wireless solutions. It is estimated that the cybersecurity market in Europe will grow by 15% annually, driven by the need for robust protection against potential breaches. This trend compels the wireless connectivity market to innovate and implement advanced security measures, such as encryption and secure access protocols, to safeguard user data and maintain trust in wireless technologies.

Surge in Mobile Data Consumption

The wireless connectivity market in Europe experiences a notable surge in mobile data consumption, driven by the increasing reliance on smartphones and mobile applications. As of 2025, mobile data traffic in Europe is projected to reach approximately 50 exabytes per month, reflecting a growth rate of around 30% annually. This trend indicates a robust demand for enhanced wireless connectivity solutions, as consumers seek faster and more reliable internet access. The proliferation of streaming services, social media, and online gaming further fuels this demand, compelling service providers to invest in advanced infrastructure. Consequently, the wireless connectivity market is poised for significant expansion, as companies strive to meet the evolving needs of consumers and businesses alike.

Advancements in Wireless Technologies

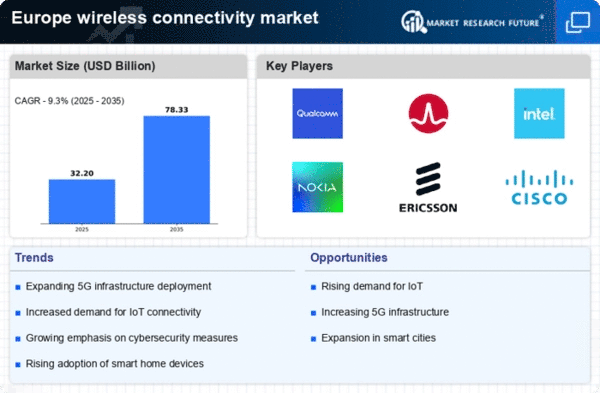

Technological advancements play a pivotal role in shaping the wireless connectivity market in Europe. Innovations such as Wi-Fi 6 and the ongoing development of 5G technology are enhancing network performance and capacity. Wi-Fi 6, for instance, offers improved speed and efficiency, accommodating more devices simultaneously. As of 2025, it is estimated that over 60% of new wireless access points in Europe will support this technology. Furthermore, the rollout of 5G networks is expected to revolutionize connectivity, enabling ultra-reliable low-latency communications. This evolution in wireless technologies not only enhances user experience but also opens new avenues for applications in sectors like healthcare, automotive, and smart cities, thereby driving growth in the wireless connectivity market.

Rising Demand for Smart Home Solutions

The increasing adoption of smart home devices significantly impacts the wireless connectivity market in Europe. As consumers become more inclined towards automation and energy efficiency, the demand for smart home solutions is projected to grow by approximately 25% annually. This trend is evident in the rising sales of smart speakers, security systems, and connected appliances. The wireless connectivity market must adapt to this demand by providing robust and secure connectivity solutions that can support a multitude of devices. Moreover, the integration of artificial intelligence in smart home systems necessitates reliable and high-speed internet access, further emphasizing the need for advanced wireless infrastructure.

Government Initiatives for Digital Infrastructure

Government initiatives aimed at enhancing digital infrastructure are crucial drivers of the wireless connectivity market in Europe. Various European nations are investing heavily in expanding broadband access, with a target of achieving 100% coverage by 2030. This commitment is reflected in the allocation of billions of euros towards improving connectivity in rural and underserved areas. Such initiatives not only promote economic growth but also foster innovation in the wireless connectivity market. By facilitating access to high-speed internet, governments are enabling businesses and individuals to leverage digital technologies, thereby stimulating demand for advanced wireless solutions.