Market Trends

Key Emerging Trends in the Expanded Polystyrene Market

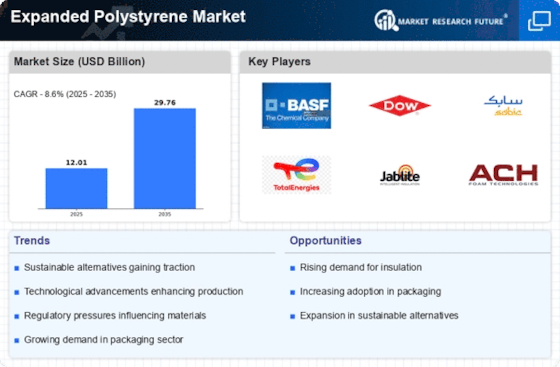

The expanded polystyrene (EPS) market has been experiencing several notable trends in recent years, driven by factors such as increasing demand from end-use industries, technological advancements, sustainability concerns, and regulatory measures. One prominent trend in the EPS market is the growing demand from the construction industry. EPS is widely used in construction for insulation purposes due to its lightweight, durable, and thermal insulation properties. As the construction sector continues to expand globally, especially in emerging economies, the demand for EPS is expected to rise further.

The growth of the expanded polystyrene market at first took place in the food industry where packing of food by bugger boxes and coffee cups were made. Highly using up of grey expanded polystyrene in construction purposes due to its insulating thermal property drives up the market. Its low water absorption capability, sound resistance capability, and mechanical resistance increase the growth of the market.

Another significant trend in the EPS market is the increasing focus on sustainability and environmental consciousness. With growing awareness about the harmful effects of plastic pollution, there has been a shift towards eco-friendly alternatives in various industries, including packaging. EPS manufacturers are responding to this trend by developing bio-based and recyclable EPS products. Additionally, there is a growing emphasis on recycling EPS waste to minimize its environmental impact. Governments and regulatory bodies are also implementing policies to encourage the recycling and responsible disposal of EPS materials.

Furthermore, technological advancements are driving innovation in the EPS market. Manufacturers are investing in research and development to improve the properties and performance of EPS products. This includes enhancing thermal insulation capabilities, increasing flame retardancy, and developing specialized EPS grades for specific applications. Advanced manufacturing techniques such as computer-aided design (CAD), computer numerical control (CNC) machining, and 3D printing are also being utilized to produce customized EPS products with complex geometries.

Moreover, the automotive industry is emerging as a significant end-user of EPS, particularly for lightweighting applications. EPS is used in automotive components such as bumpers, interior panels, and insulation materials to reduce vehicle weight and improve fuel efficiency. With the automotive industry's increasing focus on electric and hybrid vehicles, which require lighter materials to optimize battery performance, the demand for EPS is expected to grow substantially in the coming years.

In addition to these trends, the EPS market is also influenced by macroeconomic factors such as fluctuating raw material prices, currency exchange rates, and geopolitical developments. Volatility in crude oil prices, which directly impacts the cost of styrene monomer, a key raw material used in EPS production, can affect the profitability of EPS manufacturers. Currency fluctuations can also impact export-import dynamics and competitiveness in the global EPS market.

Leave a Comment