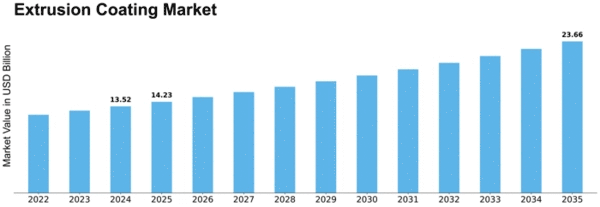

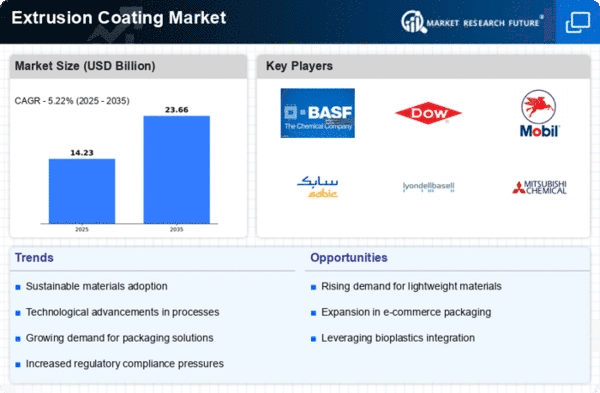

Extrusion Coating Size

Extrusion Coating Market Growth Projections and Opportunities

The Extrusion Coatings Market is influenced by several key factors that shape its dynamics:

Growth in Packaging Industry: A significant market factor driving the demand for extrusion coatings is the expansion of the packaging industry. Extrusion coatings are extensively used to enhance the performance and aesthetics of various packaging materials, including paperboard, paper, films, and aluminum foils. With the increasing demand for packaged goods globally, driven by factors such as urbanization, changing consumer lifestyles, and e-commerce growth, the demand for extrusion coatings for packaging applications is on the rise.

Demand for Barrier Properties: The dynamics of the extrusion coatings market are also influenced by the increasing demand for barrier properties in packaging materials. Extrusion coatings are applied to substrates to provide barrier properties such as moisture resistance, oxygen barrier, and grease resistance, which are crucial for preserving the quality and shelf life of packaged products. As industries such as food and beverage, pharmaceuticals, and personal care prioritize product protection and safety, the demand for extrusion coatings with enhanced barrier properties continues to grow.

Technological Advancements in Coating Processes: Continuous advancements in coating technologies play a significant role in shaping market dynamics. Innovations in extrusion coating equipment, resin formulations, and application techniques enhance the efficiency, quality, and versatility of extrusion coatings. Manufacturers are developing coatings with improved adhesion, flexibility, and barrier performance to meet the evolving needs of end-users in various industries.

Focus on Sustainability: Sustainability is emerging as a key factor influencing market dynamics in the extrusion coatings industry. With increasing environmental awareness and regulatory pressures, there is a growing demand for eco-friendly and sustainable coating solutions. Manufacturers are developing extrusion coatings with bio-based, recyclable, and compostable materials to reduce the environmental impact of packaging materials and meet the sustainability goals of brand owners and consumers.

Expansion in Construction Industry: The dynamics of the extrusion coatings market are also influenced by the expansion of the construction industry. Extrusion coatings are used in construction applications such as roofing, cladding, and insulation to provide weather resistance, UV protection, and thermal insulation. With the growing construction activities worldwide, driven by urbanization, infrastructure development, and housing projects, the demand for extrusion coatings for construction applications is expected to increase.

Rise in Demand for Flexible Packaging: The increasing demand for flexible packaging solutions is another market factor driving the growth of the extrusion coatings market. Flexible packaging offers advantages such as lightweight, convenience, and product protection, making it popular in industries such as food and beverage, healthcare, and personal care. Extrusion coatings are used to enhance the performance and aesthetics of flexible packaging materials such as films, pouches, and bags, catering to the growing demand for flexible packaging solutions.

Globalization of Supply Chains: The dynamics of the extrusion coatings market are impacted by the globalization of supply chains. As manufacturing processes become more interconnected globally, there is a need for consistent, high-quality coating solutions that can meet international standards and specifications. Market players need to adapt to the evolving landscape of global supply chains to remain competitive and meet the diverse needs of customers worldwide.

Stringent Regulatory Standards: Regulatory standards governing the use of coatings in packaging and construction applications also influence market dynamics. Regulations related to food contact materials, product safety, and environmental impact drive the development and adoption of compliant extrusion coating solutions. Manufacturers need to adhere to regulatory standards and certifications to ensure the safety and compliance of their coating products.

Consumer Preferences for Convenience: Changing consumer preferences for convenience, portability, and on-the-go consumption drive the demand for packaged products in convenient formats. Extrusion coatings enable the production of lightweight, flexible, and easy-to-use packaging materials that meet these consumer preferences. As consumers seek packaging solutions that offer convenience and functionality, the demand for extrusion coatings in flexible packaging applications continues to grow.

Leave a Comment