Market Analysis

In-depth Analysis of Fast Moving Consumer Goods Market Industry Landscape

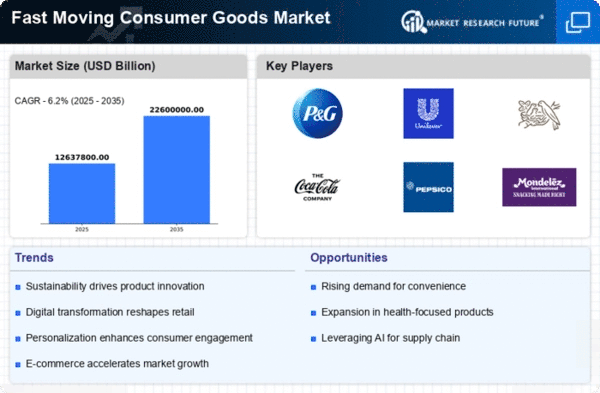

The fast-moving consumer goods (FMCG) market is influenced by a myriad of factors that shape its dynamics and growth patterns. One of the primary drivers of this market is consumer behavior and purchasing habits. FMCG products are everyday essentials that consumers purchase frequently, such as food and beverages, personal care items, household products, and toiletries. The demand for these products is largely driven by factors such as population growth, urbanization, income levels, and lifestyle changes. As populations grow and urbanize, there is an increased need for convenience and accessibility, driving the demand for FMCG products that are readily available in supermarkets, convenience stores, and online platforms.

Moreover, changing consumer preferences and trends significantly impact the FMCG market. Consumers today are increasingly health-conscious and environmentally aware, driving the demand for organic, natural, and sustainable products. As a result, FMCG companies are innovating to meet these changing preferences by offering healthier alternatives, eco-friendly packaging, and transparency in sourcing and production processes. Additionally, evolving dietary habits, such as the rise of plant-based diets and the demand for functional foods, influence the product offerings in the FMCG market, with companies introducing new products to cater to these trends.

Another crucial factor influencing the FMCG market is competition and market saturation. FMCG products often face intense competition from both established players and new entrants vying for market share. As a result, companies must differentiate their products through branding, marketing, product quality, and innovation to stand out in a crowded marketplace. Furthermore, the proliferation of private label brands and the rise of e-commerce have disrupted traditional retail channels, offering consumers more choices and driving further competition among FMCG manufacturers and retailers.

Technological advancements also play a significant role in shaping the FMCG market. The advent of e-commerce and digital technologies has transformed the way consumers shop for FMCG products, enabling them to purchase goods online with the click of a button. This shift towards online shopping has led to the rise of direct-to-consumer brands, subscription services, and digital marketing strategies aimed at reaching consumers through various online channels. Additionally, data analytics and artificial intelligence are increasingly being utilized by FMCG companies to gain insights into consumer behavior, optimize supply chains, and personalize marketing efforts.

Furthermore, economic factors such as inflation, GDP growth, and consumer confidence influence the FMCG market. During periods of economic downturn, consumers may cut back on discretionary spending and opt for lower-priced FMCG products or private label brands. Conversely, during times of economic prosperity, consumers may be more willing to splurge on premium or indulgent FMCG products. Therefore, FMCG companies must be attuned to economic fluctuations and adjust their strategies accordingly to maintain market share and profitability.

Government regulations and policies also impact the FMCG market, particularly in areas such as food safety, labeling requirements, advertising standards, and environmental regulations. Compliance with these regulations is essential for FMCG companies to ensure product quality, safety, and legality, as well as to build trust and credibility with consumers. Additionally, taxation policies, trade agreements, and tariffs can affect the cost of raw materials, production, and distribution, thereby influencing pricing strategies and market dynamics within the FMCG sector.

Leave a Comment