Top Industry Leaders in the Fatty Acid Methyl Ester Market

Fatty Acid Methyl Ester (FAME), a key ingredient in biodiesel, is carving its niche in the global energy landscape. The FAME market, spurred by environmental concerns and government regulations, is witnessing intense competition among established players and agile newcomers. This report delves into the competitive dynamics, unraveling the strategies, factors influencing market share, industry news, and recent developments shaping the FAME landscape.

Fatty Acid Methyl Ester (FAME), a key ingredient in biodiesel, is carving its niche in the global energy landscape. The FAME market, spurred by environmental concerns and government regulations, is witnessing intense competition among established players and agile newcomers. This report delves into the competitive dynamics, unraveling the strategies, factors influencing market share, industry news, and recent developments shaping the FAME landscape.

Strategic Maneuvers Fueling Growth:

-

Vertical Integration: Leading players like Wilmar International and Bunge are integrating upstream (feedstock sourcing) and downstream (biodiesel production) operations to secure feedstock supply, optimize costs, and control quality. -

Geographical Expansion: Established players like Neste and Eni are venturing into new geographies with high growth potential, particularly in Asia-Pacific and Latin America, to diversify markets and secure market share. -

Technological Innovation: Companies like Gevo and Amyris are investing in advanced technologies like renewable diesel from engineered yeast to offer high-performance, low-carbon FAME alternatives. -

Partnerships and Collaborations: Collaborations between FAME producers and automotive manufacturers like Daimler and Volkswagen are fostering development of FAME-compatible engines and vehicles, boosting market adoption. -

Sustainability Initiatives: Leading companies are adopting sustainable practices like using waste cooking oil or certified feedstock to cater to environmentally conscious consumers and comply with evolving regulations.

Market Share :

-

Feedstock Availability: Regions with abundant plant oil resources like Indonesia, Malaysia, and Argentina hold a significant market share due to cost-competitive production. -

Regional Regulations: Countries with ambitious biofuel mandates, like the EU and Brazil, offer lucrative market opportunities for FAME producers. -

Government Incentives: Tax breaks, subsidies, and blending mandates incentivize FAME production and consumption, impacting market share distribution. -

Price Fluctuations: Volatile feedstock prices can disrupt market stability and favor producers with diverse feedstock options or cost-efficient production processes.

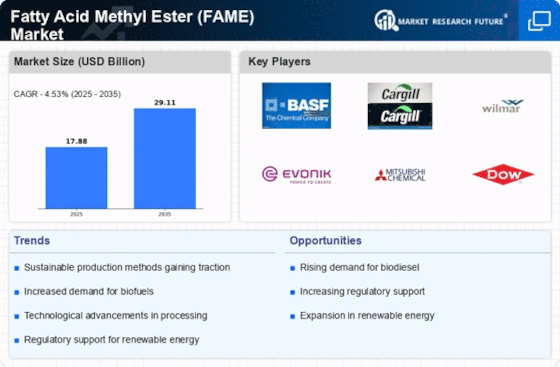

Key Players

-

BASF S.E. (Germany)

- Archer Daniels Midland Company (ADM) (U.S.)

- Cargill Inc. (U.S.)

- Wilmar International Limited (Singapore)

- Procter & Gamble (Singapore)

- Emery Oleochemicals Group (Malaysia)

- Evonik Industries AG (Germany)

- KLK Oleo (Malaysia)

- Longyan Zhuoyue New Energy Co Ltd. (China)

- Alnor Oil Co. Inc. (U.S.)

Recent Developments :

September 2023: The EU proposes a new biofuel strategy with stricter blending mandates for FAME, boosting market prospects.

October 2023: Bunge announces a partnership with Chevron to develop and produce sustainable aviation fuel from biomass, including FAME-based feedstock.

November 2023: Indonesia raises its biodiesel blending mandate to B35, further solidifying its position as a key FAME producer and consumer.

December 2023: Wilmar International acquires a leading biodiesel producer in the US, expanding its North American market presence.