Technological Innovations

Technological advancements in the production of fatty esters are likely to play a crucial role in shaping the Fatty Ester Market. Innovations such as enzymatic synthesis and green chemistry are enhancing production efficiency and reducing environmental impact. These technologies not only improve yield but also enable the development of customized fatty esters tailored to specific applications. As these technologies become more accessible, the market is expected to witness a shift towards higher quality and more diverse fatty ester products, potentially expanding the range of applications across various industries.

Food Industry Applications

The application of fatty esters in the food industry is emerging as a significant driver for the Fatty Ester Market. These compounds are utilized as emulsifiers, stabilizers, and flavor enhancers in various food products. The increasing consumer demand for processed and convenience foods is likely to bolster the market, with projections indicating that the food sector could represent nearly 25% of the fatty ester market by 2025. This growth suggests that companies focusing on food-grade fatty esters may benefit from the rising trend of food innovation and the need for improved product quality.

Sustainability Initiatives

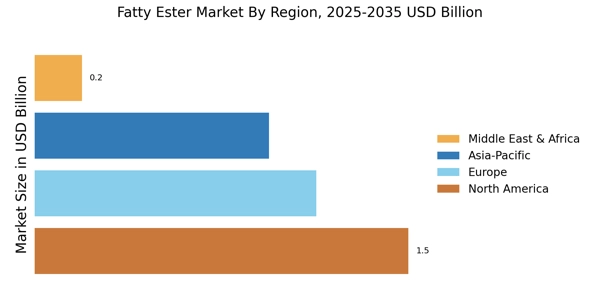

The increasing emphasis on sustainability appears to be a pivotal driver for the Fatty Ester Market. As consumers and manufacturers alike prioritize eco-friendly products, the demand for biodegradable and renewable fatty esters is likely to rise. This shift is evidenced by the growing number of companies committing to sustainable sourcing practices. In 2025, the market for bio-based fatty esters is projected to reach approximately USD 1.5 billion, reflecting a compound annual growth rate of around 6%. This trend suggests that businesses focusing on sustainable fatty ester production may gain a competitive edge, aligning with consumer preferences for environmentally responsible products.

Rising Demand in Personal Care Products

The Fatty Ester Market is experiencing a notable surge in demand from the personal care sector. Fatty esters are increasingly utilized in cosmetics and skincare formulations due to their emollient properties and ability to enhance product texture. In 2025, the personal care segment is expected to account for over 30% of the total fatty ester consumption, driven by the growing consumer inclination towards natural and organic ingredients. This trend indicates that manufacturers who innovate and adapt their fatty ester offerings to meet the specific needs of personal care brands may find lucrative opportunities in this expanding market.

Regulatory Support for Bio-based Products

Regulatory frameworks promoting bio-based products are emerging as a key driver for the Fatty Ester Market. Governments are increasingly implementing policies that encourage the use of renewable resources and sustainable practices. This regulatory support is likely to enhance the market appeal of fatty esters derived from natural sources. In 2025, it is anticipated that favorable regulations could lead to a 10% increase in the adoption of bio-based fatty esters across multiple sectors, including automotive and textiles. This trend indicates that compliance with environmental regulations may provide a competitive advantage for manufacturers in the fatty ester market.