Technological Innovations

Technological advancements are playing a pivotal role in the evolution of the Fatty Alcohol Market. Innovations in production processes, such as enzymatic synthesis and bio-refining, are enhancing efficiency and reducing costs. These technologies not only improve yield but also minimize environmental impact, aligning with the growing demand for sustainable practices. For instance, the introduction of new catalysts has enabled the production of fatty alcohols with higher purity levels, which is crucial for applications in personal care and industrial sectors. The market is witnessing a shift towards more sophisticated production techniques, which could potentially lead to a more competitive Fatty Alcohol Market. As of 2023, the market was valued at around USD 4 billion, with projections indicating a steady growth trajectory driven by these technological innovations.

Sustainability Initiatives

The increasing emphasis on sustainability within the Fatty Alcohol Market is driving demand for eco-friendly products. Manufacturers are increasingly adopting sustainable practices, such as sourcing raw materials from renewable resources. This shift is not merely a trend but a response to consumer preferences for biodegradable and non-toxic products. As a result, the market for fatty alcohols derived from natural sources is projected to grow significantly. In 2023, the market size for fatty alcohols was estimated at approximately USD 4 billion, with expectations of a compound annual growth rate of around 5% over the next several years. This focus on sustainability is likely to reshape the competitive landscape of the Fatty Alcohol Market, as companies that prioritize eco-friendly practices may gain a competitive edge.

Regulatory Support and Standards

Regulatory frameworks and standards are increasingly shaping the Fatty Alcohol Market. Governments and international organizations are implementing regulations that promote the use of safe and environmentally friendly chemicals. This regulatory support is encouraging manufacturers to adopt best practices in production and sourcing. Compliance with these regulations not only enhances product credibility but also opens up new market opportunities. In 2023, the market was influenced by various initiatives aimed at reducing harmful substances in consumer products, which has led to a greater emphasis on fatty alcohols as safer alternatives. As regulations continue to evolve, the Fatty Alcohol Market is likely to adapt, fostering innovation and ensuring that products meet the highest safety and environmental standards.

Growth in Industrial Applications

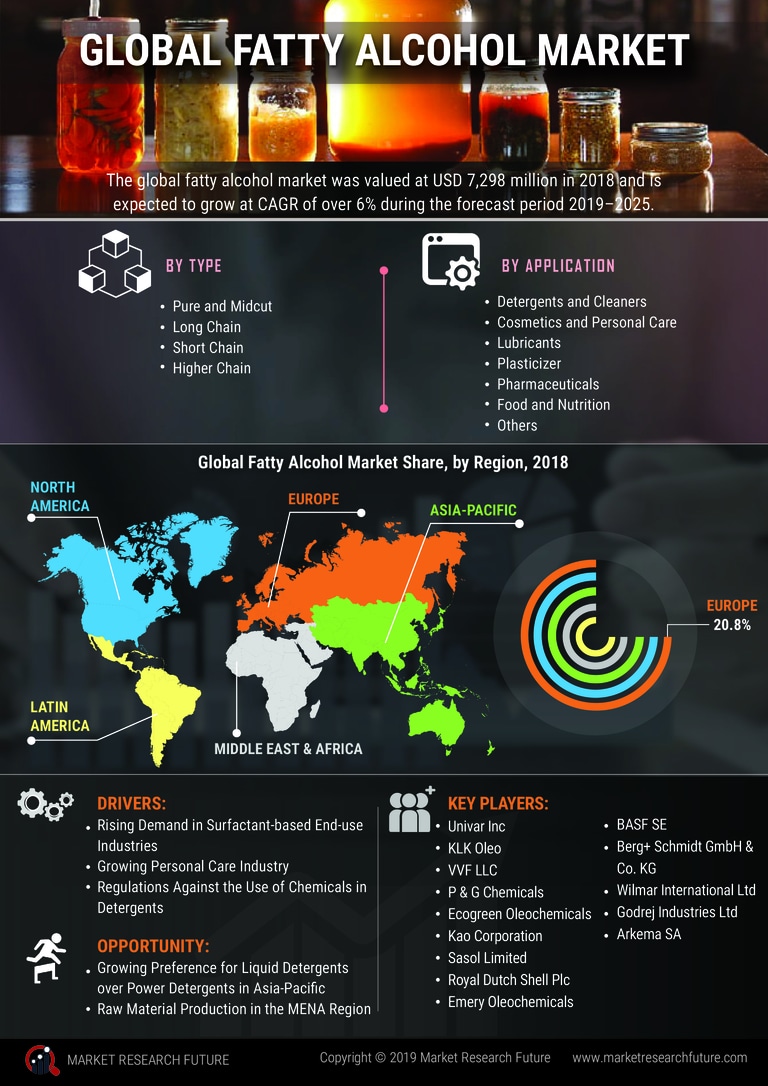

The industrial applications of fatty alcohols are expanding, contributing to the overall growth of the Fatty Alcohol Market. These compounds are utilized in the production of detergents, lubricants, and plasticizers, among other products. The increasing industrialization and urbanization in various regions are driving the demand for fatty alcohols in these applications. In 2023, the industrial segment represented approximately 30% of the total market share, indicating a substantial opportunity for growth. As industries seek to enhance product performance and sustainability, the demand for high-quality fatty alcohols is likely to rise. This trend suggests that the Fatty Alcohol Market may experience a significant transformation, with a focus on meeting the evolving needs of industrial consumers.

Rising Demand in Personal Care Products

The personal care sector is experiencing a surge in demand for fatty alcohols, which are essential ingredients in various formulations. The Fatty Alcohol Market is benefiting from this trend, as fatty alcohols are widely used as emollients, emulsifiers, and surfactants in cosmetics and skincare products. The increasing consumer awareness regarding the benefits of natural ingredients is propelling the demand for fatty alcohols derived from plant sources. In 2023, the personal care segment accounted for nearly 40% of the total fatty alcohol market share, reflecting a robust growth potential. This trend is expected to continue, with the personal care industry projected to expand at a rate of 6% annually, further solidifying the position of fatty alcohols within the Fatty Alcohol Market.