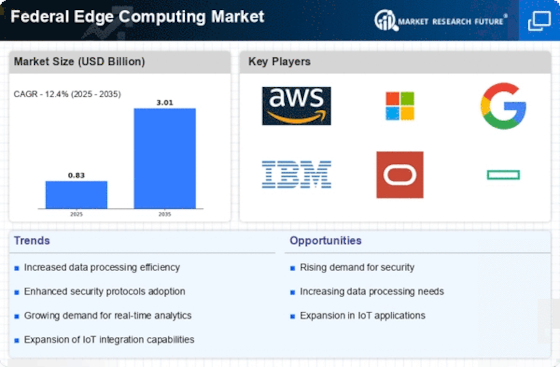

Federal Edge Computing Size

Federal Edge Computing Market Growth Projections and Opportunities

The Federal Edge Computing market's market dynamics are deeply affected by the unique needs and difficulties of federal government agencies that manage large volumes of data, ensure security, and provide quick services to their citizens. One major driver that shapes the market dynamics for Federal Edge Computing is the increasing amount and complexity of data generated by governments. Traditional strategies for processing data centrally become inefficient when federal bodies gather and analyze huge datasets from sensors, IoTs, and surveillance systems, among other sources. The significance of security in the market dynamics of Federal Edge Computing is informed by the nature of governmental information as well as the importance of protecting critical infrastructure. These architectures let various units within a federal department install measures that improve data safety while being used or transmitted. Federal Edge Computing's market dynamics are influenced greatly by the demand for improved mission capabilities and operational efficiency. This is because edge computing helps government organizations to execute their critical missions better than before. Market dynamics rely heavily on technological advancements in this field, especially regarding the hardware and software components related to Edge Computing. It implies that edge computing technologies have continuously evolved to cater to specific requirements needed by different federal agencies. Additionally, digital transformation initiatives by the US government add to this dynamic (Shakir et al., 2019). For example, modernization efforts aimed at updating IT infrastructure within various government institutions bring out how important edge computing can be in supporting emerging technologies such as Artificial Intelligence (AI), machine learning (ML), and the Internet of Things (IoT). In this sense, its competitive landscape makes Federal Edge Computing dynamic because many vendors vie for contracts and offer tailored solutions specific to each government agency's requirements. This means that any product introduced into this market must be compatible with other existing systems while seamlessly blending with old infrastructures still running such legacy applications in most cases known as "Islands" or "silos". Moreover, there were distinct impacts of COVID-19 on various aspects of governments' activities, including Federal Edge Computing market dynamics. This is because the pandemic underscored the need for building resilient and distributed IT infrastructures that can support remote work and virtual collaboration and enable rapid deployment of computing resources.

Leave a Comment