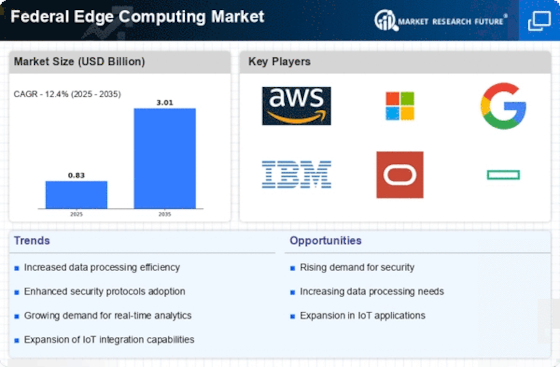

Top Industry Leaders in the Federal Edge Computing Market

Competitive Landscape of the Federal Edge Computing Market:

The federal edge computing market, a burgeoning segment within the broader edge computing landscape, is experiencing a surge in activity driven by the convergence of evolving government needs and technological advancements. This dynamic space presents both opportunities and challenges for established players and emerging contenders alike.

Key Players:

- Cisco

- AWS

- Dell Technologies

- HPE

- Huawei

- IBM

- Intel

- Litmus Automation

- Microsoft

- Nokia

- ADLINK

- Axellio

Factors for Market Share Analysis:

- Security and Compliance: The ability to meet stringent federal data security and privacy regulations like FISMA and HIPAA is paramount. Robust encryption, secure communication protocols, and compliance certifications play a crucial role in securing contracts.

- Technological Innovation: Offering cutting-edge hardware, efficient data processing algorithms, and advanced edge analytics capabilities tailored to specific federal use cases gives vendors a competitive edge. Integration with AI and machine learning further enhances the value proposition.

- Partnerships and Collaborations: Collaborating with system integrators, cybersecurity experts, and industry-specific solution providers broadens the ecosystem, increases market reach, and allows for customization to meet diverse agency needs.

- Pricing Strategies: While cost leadership can attract agencies with budget constraints, premium providers emphasizing robust security features, scalability, and comprehensive services carve out a niche market segment willing to pay more for advanced solutions.

- Scalability and Interoperability: Scalable solutions that seamlessly integrate with existing government IT infrastructure are highly sought-after. Open platforms and adherence to industry standards ensure smooth deployment and avoid vendor lock-in.

New and Emerging Players:

The market is seeing a surge of innovative startups like FogHorn Systems, Athonet, and Cumulocity offering specialized edge solutions for niche applications like smart cities, border security, and environmental monitoring. Their agility and focus on specific use cases make them strong contenders for targeted contracts.

Current Company Investment Trends:

Companies are heavily investing in R&D to develop faster, more efficient, and secure edge devices, software platforms, and analytics tools. Additionally, acquisitions and partnerships are on the rise as companies seek to expand their offerings and gain access to new markets and expertise. Notably, Dell's acquisition of EdgeX Foundry and VMware's acquisition of Pivotal CloudWare are recent examples of this trend.

Latest Company Updates:

January 10, 2024, The National Institute of Standards and Technology (NIST) published a draft framework for secure edge computing, providing guidelines and best practices for federal agencies.

December 5, 2023, This project aims to improve data processing and communication at sea, enabling faster decision-making and enhanced situational awareness.

December 8, 2023, Microsoft and Accenture announced a collaboration to develop and deploy edge computing solutions for federal agencies.