Collaboration with Private Sector

Collaboration between federal agencies and the private sector is emerging as a key driver in the federal edge-computing market. Partnerships with technology firms enable federal entities to leverage cutting-edge innovations and expertise in edge computing. This collaboration is particularly beneficial for developing tailored solutions that meet specific federal requirements. As agencies seek to modernize their IT infrastructures, the federal edge-computing market is likely to see an influx of joint ventures and public-private partnerships. These collaborations can accelerate the deployment of advanced edge computing technologies, potentially increasing market growth by 15% over the next few years. By working together, federal agencies and private companies can enhance the effectiveness and efficiency of edge computing solutions.

Enhanced Focus on Data Sovereignty

Data sovereignty is becoming increasingly important within the federal edge-computing market, particularly in the context of regulatory compliance and national security. Federal agencies are mandated to ensure that sensitive data remains within national borders, which drives the need for localized edge computing solutions. This focus on data sovereignty is likely to influence procurement strategies, as agencies seek vendors that can provide compliant solutions. the market will see a shift towards infrastructure that supports data residency requirements, potentially increasing the demand for edge computing services by 30% over the next few years. As federal entities navigate the complexities of data governance, the emphasis on sovereignty will shape the landscape of the federal edge-computing market.

Growing Need for Network Resilience

The federal edge-computing market is witnessing a growing need for network resilience, driven by the increasing frequency of cyber threats and the need for uninterrupted service delivery. Federal agencies are prioritizing the development of robust edge computing infrastructures that can withstand disruptions and maintain operational continuity. This focus on resilience is likely to lead to increased investments in redundant systems and advanced security measures. The market for resilient edge computing solutions is projected to grow by 20% annually as agencies recognize the importance of safeguarding critical operations. By enhancing network resilience, federal entities can ensure that their edge computing capabilities remain reliable, thereby reinforcing the overall security posture of the federal edge-computing market.

Integration of Artificial Intelligence

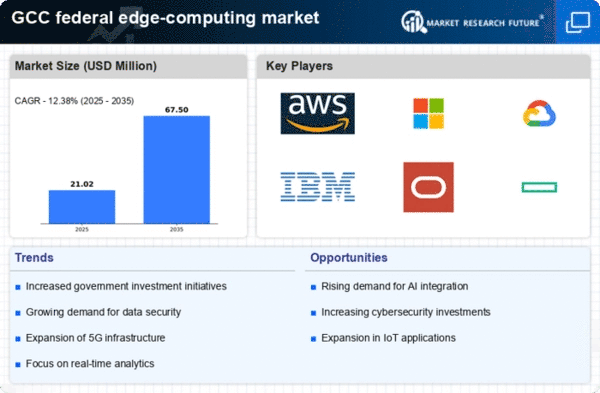

The integration of artificial intelligence (AI) into the federal edge-computing market is emerging as a pivotal driver. AI technologies enhance the capabilities of edge devices, enabling them to perform complex tasks such as predictive analytics and automated decision-making. This integration is particularly relevant for federal agencies that require advanced analytics for security and operational efficiency. The market for AI in edge computing is anticipated to reach $5 billion by 2026, reflecting a growing recognition of its potential. As federal entities adopt AI-driven solutions, they can leverage data more effectively, leading to improved outcomes in various sectors, including healthcare and defense. The synergy between AI and edge computing is likely to accelerate innovation, making it a critical component of the federal edge-computing market.

Rising Demand for Real-Time Data Processing

The federal edge-computing market is experiencing a notable increase in demand for real-time data processing capabilities. This trend is driven by the need for immediate insights and decision-making in various federal applications, including defense and public safety. As agencies seek to enhance operational efficiency, the market is projected to grow at a CAGR of approximately 25% over the next five years. The ability to process data at the edge reduces latency and bandwidth usage, which is crucial for mission-critical operations. Consequently, investments in edge-computing technologies are likely to rise, as federal entities prioritize solutions that enable rapid data analysis and response. This shift towards real-time processing is expected to redefine operational frameworks within the federal edge-computing market, fostering innovation and improved service delivery.