Enhanced Connectivity and 5G Deployment

The deployment of 5G technology in Japan plays a pivotal role in shaping the federal edge-computing market. Enhanced connectivity provided by 5G networks facilitates faster data transmission and lower latency, which are essential for edge computing applications. As 5G coverage expands, government agencies are likely to leverage this technology to implement more efficient and responsive systems. The anticipated increase in 5G adoption is expected to boost the federal edge-computing market by enabling new use cases, such as smart city applications and remote monitoring systems, thereby enhancing overall operational capabilities.

Focus on Data Sovereignty and Compliance

In Japan, the federal edge-computing market is increasingly driven by concerns regarding data sovereignty and compliance with local regulations. Government agencies are under pressure to ensure that sensitive data remains within national borders, leading to a preference for edge computing solutions that can process data locally. This focus on compliance is likely to shape procurement strategies, as agencies seek technologies that align with Japan's stringent data protection laws. As a result, the federal edge-computing market may witness a shift towards solutions that prioritize data security and regulatory adherence, fostering trust and reliability in government operations.

Rising Demand for Real-Time Data Processing

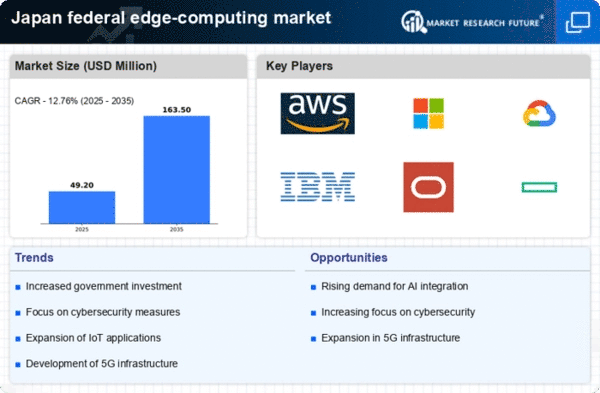

The federal edge-computing market in Japan experiences a notable surge in demand for real-time data processing capabilities. This demand is driven by the increasing need for immediate insights in various sectors, including defense and public safety. As government agencies seek to enhance operational efficiency, the ability to process data at the edge becomes crucial. Reports indicate that the market for edge computing solutions is projected to grow at a CAGR of approximately 25% over the next five years. This growth reflects the urgency for timely decision-making and the optimization of resources, thereby propelling the federal edge-computing market forward.

Government Initiatives for Digital Transformation

Japan's federal edge-computing market is significantly influenced by government initiatives aimed at digital transformation. The Japanese government has launched various programs to modernize public services and enhance data management capabilities. These initiatives often emphasize the integration of edge computing technologies to improve service delivery and operational efficiency. For instance, the government's budget allocation for digital infrastructure has increased by 15% in recent years, indicating a strong commitment to adopting advanced technologies. Such initiatives not only foster innovation but also create a conducive environment for the growth of the federal edge-computing market.

Integration of Artificial Intelligence at the Edge

The integration of artificial intelligence (AI) into edge computing solutions is emerging as a key driver in the federal edge-computing market. AI technologies enable advanced analytics and decision-making capabilities at the edge, allowing government agencies to process vast amounts of data efficiently. This integration is particularly relevant in sectors such as defense and public safety, where timely insights are critical. The market for AI-driven edge computing solutions is expected to grow substantially, with estimates suggesting a potential increase of 30% in adoption rates over the next few years. This trend indicates a shift towards more intelligent and autonomous systems within the federal edge-computing market.