Enhanced Security Requirements

Security concerns are paramount in the federal edge-computing market, particularly in France, where data breaches can have severe implications. The need for robust cybersecurity measures is driving the adoption of edge computing solutions that can process sensitive information closer to the source. By minimizing data transmission to centralized cloud servers, agencies can reduce vulnerability to cyber threats. The market is expected to witness an increase in investments in security technologies, with projections indicating a potential growth of 30% in security-focused edge solutions by 2026. This heightened focus on security is reshaping the federal edge-computing market.

Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the federal edge-computing market. In France, various funding programs are being introduced to support the development and deployment of edge computing technologies. These initiatives aim to enhance the technological capabilities of public sector organizations, thereby fostering innovation. For instance, the French government has allocated €200 million towards digital transformation projects, which include edge computing solutions. Such financial backing is likely to stimulate growth in the market, encouraging agencies to adopt advanced technologies that improve service delivery and operational efficiency.

Growing Internet of Things (IoT) Adoption

The proliferation of Internet of Things (IoT) devices is significantly impacting the federal edge-computing market. As more devices become interconnected, the need for efficient data processing at the edge becomes increasingly apparent. In France, the number of IoT devices is expected to reach 1 billion by 2026, creating a substantial demand for edge computing solutions that can handle the influx of data generated. This trend suggests that agencies will need to invest in edge infrastructure to manage and analyze data locally, thereby enhancing responsiveness and reducing latency in critical applications.

Rising Demand for Real-Time Data Processing

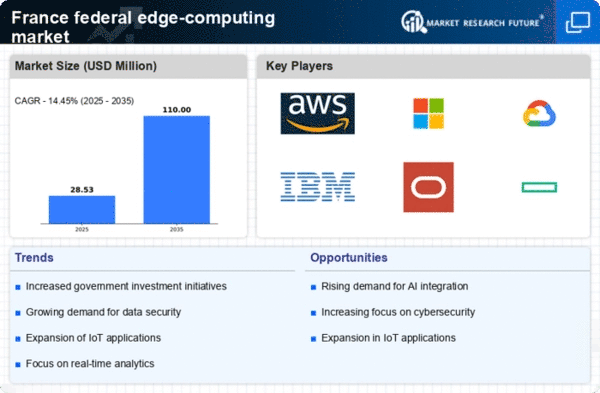

The federal edge-computing market is experiencing a notable surge in demand for real-time data processing capabilities. This trend is driven by the increasing need for immediate insights in various sectors, including defense and public safety. As government agencies in France seek to enhance operational efficiency, the ability to process data at the edge becomes crucial. Reports indicate that the market for edge computing solutions is projected to grow at a CAGR of 25% from 2024 to 2027. This growth is likely fueled by the necessity for timely decision-making in critical situations, thereby reinforcing the importance of edge computing in the federal landscape.

Shift Towards Decentralized Computing Models

The federal edge-computing market is witnessing a shift towards decentralized computing models, which offer enhanced flexibility and scalability. This transition is particularly relevant for government agencies in France, as they seek to optimize resource allocation and improve service delivery. Decentralized models allow for localized data processing, which can lead to reduced operational costs and improved performance. Analysts predict that the adoption of decentralized edge computing solutions could increase by 40% over the next few years, as agencies recognize the benefits of distributing computing resources closer to end-users.