Enhanced Focus on Data Sovereignty

In the context of the federal edge-computing market in APAC, data sovereignty has emerged as a critical driver. Governments are increasingly prioritizing the localization of data to comply with national regulations and protect sensitive information. This focus on data sovereignty necessitates the deployment of edge computing solutions that can process and store data within national borders. As a result, agencies are investing in edge infrastructure that aligns with local laws and regulations, ensuring that data remains secure and accessible. The implications for the federal edge-computing market are profound, as agencies may allocate upwards of 30% of their IT budgets to ensure compliance with data sovereignty requirements. This trend not only fosters trust among citizens but also enhances the overall security posture of government operations.

Rising Demand for Real-Time Data Processing

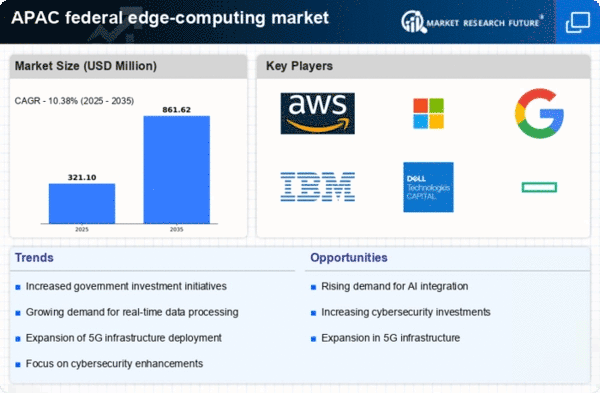

The federal edge-computing market in APAC is experiencing a notable surge in demand for real-time data processing capabilities. This trend is largely driven by the increasing need for immediate insights in various sectors, including defense, healthcare, and public safety. As agencies seek to enhance operational efficiency, the ability to process data at the edge rather than relying on centralized data centers becomes crucial. Reports indicate that the market for edge computing in APAC is projected to grow at a CAGR of approximately 25% over the next five years. This growth reflects the urgency for agencies to leverage data analytics in real-time, thereby improving decision-making processes and operational responsiveness. Consequently, the federal edge-computing market is likely to see significant investments aimed at developing infrastructure that supports these capabilities.

Collaboration with Local Technology Startups

The federal edge-computing market in APAC is increasingly characterized by collaboration with local technology startups. These partnerships enable government agencies to leverage innovative solutions and accelerate the deployment of edge computing technologies. Startups often bring agility and cutting-edge expertise, which can complement the capabilities of established firms. This trend is particularly relevant as agencies seek to enhance their technological infrastructure while fostering local economic growth. Reports suggest that collaborations with startups could account for approximately 20% of federal technology investments in the coming years. By engaging with local innovators, agencies not only gain access to novel solutions but also contribute to the development of a vibrant technology ecosystem within the region, thereby strengthening the federal edge-computing market.

Growing Need for Enhanced Cybersecurity Measures

As cyber threats continue to evolve, the federal edge-computing market in APAC is witnessing a growing emphasis on enhanced cybersecurity measures. Agencies are increasingly aware of the vulnerabilities associated with edge computing, where data is processed closer to the source. This awareness drives the demand for robust security protocols and solutions that can safeguard sensitive information. Investments in cybersecurity technologies, such as advanced encryption and intrusion detection systems, are becoming paramount. It is estimated that the federal sector may allocate up to 25% of its IT budgets to bolster cybersecurity initiatives related to edge computing. This focus on security not only protects critical data but also ensures compliance with regulatory frameworks, thereby fostering trust in the federal edge-computing market.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the federal edge-computing market in APAC. These technologies enable agencies to analyze vast amounts of data at the edge, facilitating faster and more accurate decision-making. The ability to deploy AI and ML algorithms directly on edge devices allows for improved predictive analytics and automation of processes. As agencies recognize the potential of these technologies, investments in AI-driven edge solutions are expected to increase, with projections indicating a market growth of around 40% in this segment by 2026. This integration not only enhances operational efficiency but also empowers agencies to respond proactively to emerging challenges, thereby transforming the landscape of the federal edge-computing market.