Market Analysis

In-depth Analysis of Feed Preservatives Market Industry Landscape

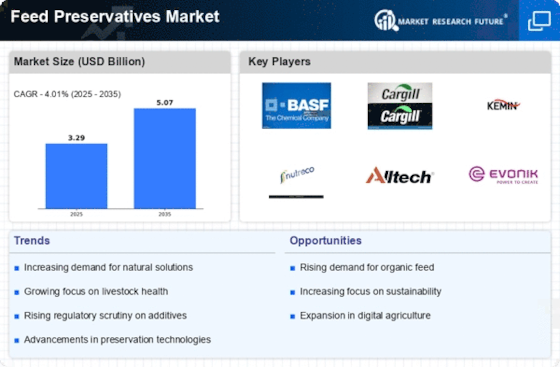

Many variables affect the feed preservatives market's growth and dynamics. The rising worldwide demand for livestock and aquaculture products is important. Preservatives keep animal feeds fresh, avoid spoiling, and optimize nutrition for cattle and aquatic animals. As the global population grows, meat and seafood demand rises, boosting the market for effective feed preservatives.

Livestock and aquaculture operations substantially impact feed preservatives. Modern agricultural methods, intensive production systems, and the worldwide push for efficient and sustainable agriculture emphasize feed preservation to minimize nutrient deterioration and protect animal health. Advances in genetics and breeding typically require feed preservatives to preserve specific feed compositions.

The feed preservatives market is driven by economic circumstances and commodity prices. Feed preservative manufacturing costs depend on raw material prices, such as organic acids and antioxidants. Economic stability, currency exchange rates, and farmer affordability affect market patterns and purchase decisions, affecting market size.

Technology in feed preservation and formulations drives industry growth and innovation. Research and development aim to increase feed preservative effectiveness, stability, and environmental impact. Encapsulation and controlled-release formulations make feed preservative administration more accurate and efficient, supporting the industry's sustainability and resource usage goals.

Climate change affects feed storage conditions and feed preservative demand. Mold and microbial contamination in stored feeds can rise with temperature and humidity changes. Effective feed preservatives are needed to maintain feed quality and nutritional value as climatic change increases.

The feed preservatives industry is indirectly affected by consumer demand for safe, high-quality animal products. As customers become increasingly picky about food safety and provenance, livestock and aquaculture sectors use feed preservatives to protect animal feeds. Consumer need for efficient preservatives helps fulfill market expectations and food safety regulations.

The feed preservatives market is expected to grow 8.1% from 2022 to 2030. Food preservatives prevent spoilage, and the industry is expected to reach USD 13.8 billion by 2030. To keep animal fats and oils from oxidizing during manufacture, kibble and dry pet food need preservatives or antioxidants. Feed preservatives prevent food deterioration and increase shelf life in animal foods.

Leave a Comment