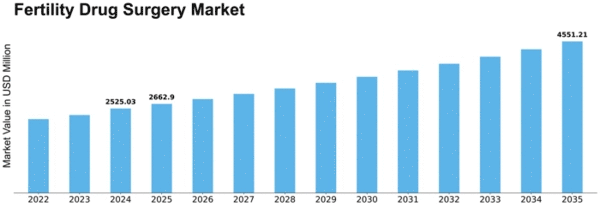

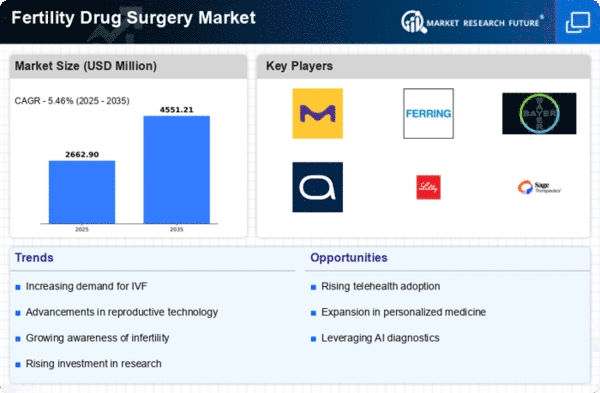

Fertility Drug Surgery Size

Fertility Drug Surgery Market Growth Projections and Opportunities

The fertility drug and surgery market is profoundly impacted by the rising prevalence of infertility. As infertility rates continue to increase globally due to various factors such as lifestyle changes, delayed pregnancies, and medical conditions, the demand for fertility interventions, including drugs and surgeries, experiences a parallel surge. Advances in ART, including in vitro fertilization (IVF) and intrauterine insemination (IUI), drive the fertility drug and surgery market. Improved success rates and the development of innovative techniques contribute to the overall growth of the market as couples seek effective fertility solutions. Societal norms and life-style choices, which result in delayed child bearing are also contributory factors of age related infertility. The use of the fertility drug and surgery market focuses on treating people with age related challenges thus highlighting the intervention in later reproductive periods. The dynamics of the market are greatly determined by regulatory approvals for fertility drugs and surgical procedures. Regulatory standards and the approval process influence market access for pharmaceutical firms as well as surgical equipment manufacturers determining competitive environment. The growth of fertility treatments in the entire world enhances market development. Greater accessibility to fertility clinics, more advanced treatments and a wider range of fertility drugs and surgical options in various regions improve the market reach resulting into attracting patients from diverse sections. Financial factors are very important in the choices relating to fertility treatment. The provision of insurance coverage and financial support programs for fertility treatments impact patient decisions, thus contributing to the market demand for fertility drugs and surgeries. Accepting and utilizing fertility drugs as well as surgeries is influenced by cultural or societal attitudes. The changing societal attitudes and heightened awareness could drive greater acceptance of fertility interventions, which will favourably impact the growth in market. Male infertility has been gaining the attention of market towards developing drugs and surgical interventions to diagnose male reproductive problems. In response to increased public awareness on the issue of male infertility, this market provides specialized solutions not only for men but also women with possible reproductive disorders. Associations between pharmaceutical firms, fertility centers and healthcare services are behind the market’s structure. Partnerships support research initiatives, expansion of new treatment options as well as overall progress in the field fertility care.

Medical tourism in the field of fertility treatment affects market dynamics. Patients may travel to countries with advanced fertility clinics and favorable regulatory environments, influencing the demand for specific fertility drugs and surgical procedures in those regions.

Leave a Comment