Market Trends

Key Emerging Trends in the Fertility Drug Surgery Market

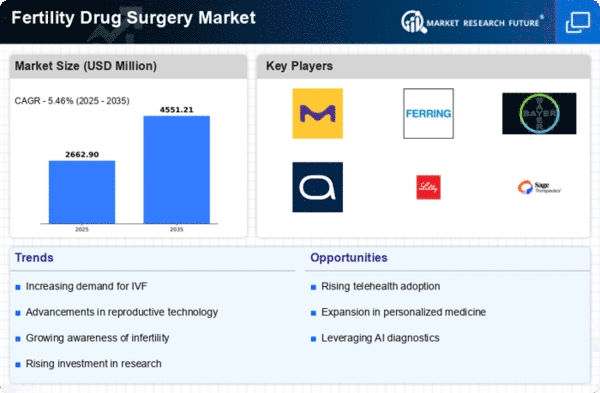

The fertility drug and surgery market are witnessing growth driven by rising infertility rates globally. Factors such as delayed family planning, lifestyle changes, and environmental factors contribute to the increasing prevalence of infertility, prompting a higher demand for fertility treatments. The fertility market is being shaped by constant innovations in assisted reproductive technologies such as IVF and ICSI. The advanced techniques, typically combined with fertility medications in most cases; have higher success rates that spur the use of holistic approaches to managing infertility. Fertility drugs and surgeries stand as one of the booming markets around the world owing to a trend among couples who put off parenthood for several reasons ranging from career pursuits, financial instability etc. With many people and couples coming to terms with the fact that they would have children at a later stage in their lives, fertility treatments become one of those essential remedies available for addressing age-related issues. As a result, the society’s attitude towards assisted reproduction is changing; people are becoming more willing to accept fertility drugs and surgeries. This cultural change eliminates the stigma associated and makes individuals, as well as couples access fertility treatments to be viewed a viable solution for reproductive challenges. The rise in public knowledge about the issues on fertility, treatment options and readily available drugs has been a major market trend driver. The educational campaigns and proactive healthcare initiatives ensure that the population is well informed, thereby leading to early intervention for fertility solutions. The pharmaceutical formulations and drug delivery systems are revolutionizing the fertility drugs market. The delivery of better and more focused fertility drugs, usually with lower side effects makes the treatment a lot easier on patients so increasing efficiency. The direction of personalized medicine is affecting the market fertility drugs. Personalizing drug regimens according to the patients’ individual characteristics and genetic components leads to more effective fertility interventions, increasing chances of conception. The market for fertility surgery has witnessed a clear shift to less invasive and minimally invasive procedures. Fertility interventions involving laparoscopic and hysteroscopy as techniques also provides reduced recover times with less complications, hence making them more preferable options. Globalization of fertility services is positively affecting the market growth. The demand for cross-border reproductive care and medical tourism is increasing day by day as people travel to other countries in order get more advanced fertility treatments. The artificial intelligence is also being used in fertility treatments mainly for predicting and optimizing results. AI algorithms apply to patient data analysis; they find patterns and help making decisions that lead to the high efficiency of fertility treatments.

Increasing regulatory support and insurance coverage for fertility treatments are contributing to market trends. The availability of insurance coverage and supportive policies in some regions alleviate financial barriers, making fertility treatments more accessible to a broader population.

Leave a Comment