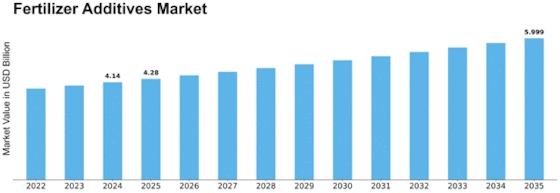

Fertilizer Additives Size

Fertilizer Additives Market Growth Projections and Opportunities

fertilizer additives market size is influenced by a myriad of factors that collectively shape its dynamics and growth trajectory. One of the primary drivers of market size is the global population growth. As the world population continues to expand, the demand for food increases, placing significant pressure on agricultural systems to enhance crop yields. Fertilizer additives play a crucial role in this scenario by improving the efficiency of fertilizers, ensuring that plants receive the necessary nutrients for optimal growth. The need to feed a growing population propels the demand for fertilizer additives, contributing to the overall market size.

Another key factor influencing the market size is the trend towards intensive and commercial agriculture. With a shift from traditional farming practices to modern, technology-driven agriculture, there is an increased reliance on fertilizers to boost productivity. Fertilizer additives become essential in this context, as they enhance the performance of fertilizers, making them more effective in providing nutrients to crops. The expansion of commercial agriculture, particularly in emerging economies, further amplifies the demand for fertilizer additives, driving market growth.

Environmental concerns and regulations also play a pivotal role in shaping the fertilizer additives market size. With a growing awareness of the environmental impact of conventional fertilizers, there is a push towards sustainable and eco-friendly agricultural practices. Fertilizer additives that minimize nutrient runoff and soil pollution are increasingly favored to meet stringent environmental standards. The market size is thus influenced by the adoption of environmentally responsible additives, as farmers and agricultural stakeholders seek solutions that align with sustainable farming practices.

Technological advancements and innovations contribute significantly to the market size of fertilizer additives. The development of advanced formulations, such as slow-release fertilizers and micronutrient-enriched additives, enhances the efficacy of fertilizers and addresses specific nutrient deficiencies in soils. Additionally, the integration of precision agriculture technologies, including sensors and data analytics, optimizes the application of fertilizer additives, further driving market expansion. Companies that invest in research and development to introduce cutting-edge products gain a competitive edge, influencing the overall market size.

Economic factors, including commodity prices and farm income, also impact the market size of fertilizer additives. Fluctuations in commodity prices can influence farmers' purchasing decisions and their willingness to invest in agricultural inputs, including fertilizer additives. Moreover, government policies, subsidies, and support programs can either stimulate or hinder market growth. The affordability of fertilizer additives is a crucial consideration for farmers, especially in regions where economic conditions play a significant role in agricultural practices.

Global trade dynamics and geopolitical factors contribute to the fertilizer additives market size. As agriculture becomes increasingly interconnected on a global scale, trade policies and geopolitical events can influence the availability and affordability of fertilizer additives. Companies operating in this market must navigate international trade regulations and geopolitical uncertainties to ensure a stable supply chain and market presence. Moreover, opportunities for market expansion in new regions contribute to the overall market size as companies explore and capitalize on emerging markets.

In conclusion, the fertilizer additives market size is shaped by a combination of demographic, economic, environmental, and technological factors. The need to sustainably feed a growing population, coupled with the adoption of modern agricultural practices, is driving the demand for fertilizer additives. Environmental considerations, technological innovations, and global economic dynamics further influence the market size, making it imperative for industry players to adapt to evolving factors to capitalize on growth opportunities in this dynamic and essential sector of the agriculture industry.

Leave a Comment