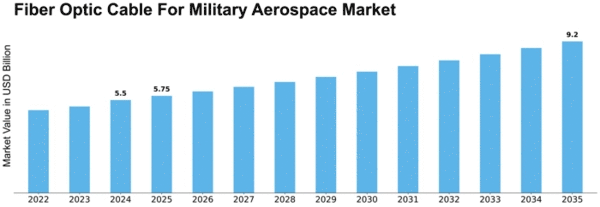

Fiber Optic Cable For Military Aerospace Size

Fiber Optic Cable For Military Aerospace Market Growth Projections and Opportunities

Fiber optic cables on military and aerospace have different forces that have made it to be important in the military and aerospace sectors. The major driver of this market is because of the increased reliance on data communication, information exchange within the military as well as aerospace applications. Fiber optic cables are considered to be a higher bandwidth and safe mode for exchanging data. They also have other advantages such as faster transmission speeds, immunity against electromagnetic interference (EMI) and improved data security. As modern military operations become more centered on data and aerospace systems, there is an increasing demand for advanced and dependable fiber optic cables to meet their strict requirements.

Technological innovation is another factor that shapes Fiber Optic Cables for Military and Aerospace market. Production of high performance solutions is driven by continuous advancements in fiber optics technology such as improvement of cable design, manufacturing processes, development of ruggedized/lightweight cables amongst others. To enhance versatility or durability fiber optic connectors have been innovated on together with termination techniques as well as deployment methodologies which makes them fit enough for any military or aerospace setting.

The demand for these types of cables has been driven by geopolitical considerations rather than economic reasons due to the fact that these countries invest heavily in defense capabilities thus requiring secure and reliable networks in order to achieve superiority over other countries in terms of defense measures. Due to evolving threats in geopolitical landscape strategic considerations prompt defense forces to seek out advanced communications resiliency instead. In case where there is need for secure transmission of critical information between defense operations and aerospace applications, then fiber optic cables are ideal.

Fiber Optic Cables Industry regulations/standards require compliance with strict legal protocols regarding safety precautions when designing/manufacturing/deploying them within the industry & such norms therefore affect business strategy including targeting & marketing plans required by MI/Aerospace sector. Different rules apply while designing, deploying or manufacturing wires so as to ensure they conform with safety standards within MI/Aerospace sectors. Fiber optic cable suppliers must produce reliable and certified cables according to these rules in order to meet the unique requirements of military and aerospace environments.

Fiber optic cables are increasingly used in avionics and aerospace systems, a trend which is driving industry growth. The main use of cables installed on aircrafts, spacecrafts or unmanned aerial vehicles (UAV’s) is connecting various components of the said machines. These light weight products can be easily moved from one point to another without being interfered with by electromagnetic waves hence they can be effectively used for transmitting data between sensors, communication systems as well as control units within aerospace platforms. Advanced avionic systems are driving demand for reliable high performance fiber optic cables in such applications with those involving space exploration technologies.

Military spending patterns based on geopolitical concerns and security threats influence advanced communications technologies’ purchase and implementation. On the other hand, economic stability plus growth in the defense/aviation industries stimulates investments into fiber optics while budget constraints could lead to prioritization & optimization in communication capabilities.”

Leave a Comment