North America : Market Leader in Innovation

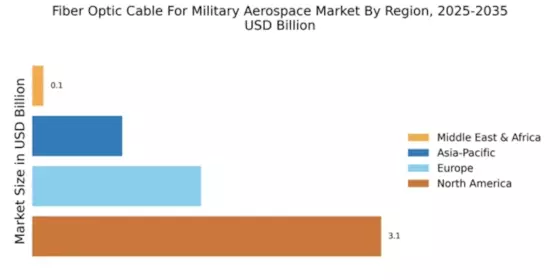

North America is poised to maintain its leadership in the Fiber Optic Cable for Military Aerospace market, holding a significant market share of 3.1 billion. The region's growth is driven by increasing defense budgets, technological advancements, and a rising demand for high-speed communication systems. Regulatory support and investments in military infrastructure further catalyze this growth, ensuring that North America remains at the forefront of innovation in military aerospace technologies.

The competitive landscape in North America is robust, featuring key players such as Corning, TE Connectivity, and General Dynamics. These companies are leveraging advanced technologies to enhance product offerings and meet the stringent requirements of military applications. The presence of established defense contractors and a strong focus on R&D contribute to a dynamic market environment, positioning North America as a hub for fiber optic solutions in military aerospace.

Europe : Emerging Market with Potential

Europe is witnessing a growing demand for Fiber Optic Cables in the Military Aerospace sector, with a market size of 1.5 billion. Factors such as increasing defense collaborations among EU nations, advancements in communication technologies, and a focus on enhancing military capabilities are driving this growth. Regulatory frameworks aimed at improving defense readiness and interoperability among member states further support market expansion, making Europe a key player in this sector.

Leading countries in this region include the UK, Germany, and France, where significant investments in defense technology are being made. The competitive landscape features companies like Furukawa Electric and L3Harris Technologies, which are innovating to meet the specific needs of military applications. The presence of these key players, along with a collaborative approach among European nations, positions the region for substantial growth in the fiber optic market for military aerospace.

Asia-Pacific : Growing Demand in Defense Sector

Asia-Pacific is emerging as a significant market for Fiber Optic Cables in Military Aerospace, with a market size of 0.8 billion. The region's growth is fueled by increasing defense expenditures, modernization of military infrastructure, and a rising focus on secure communication systems. Countries are investing in advanced technologies to enhance their military capabilities, supported by government initiatives aimed at boosting local manufacturing and innovation in defense technologies.

Key players in the Asia-Pacific market include companies like Optical Cable Corporation and local manufacturers. Countries such as Japan and Australia are leading the charge, with substantial investments in defense technology and collaborations with global firms. The competitive landscape is evolving, with a focus on developing high-performance fiber optic solutions tailored for military applications, ensuring the region's growing importance in this sector.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is in the nascent stages of developing its Fiber Optic Cable market for Military Aerospace, with a market size of 0.1 billion. The growth is primarily driven by increasing defense budgets and a focus on enhancing military communication capabilities. However, challenges such as political instability and varying levels of technological advancement across countries may hinder rapid growth. Regulatory frameworks are gradually evolving to support defense initiatives, but more robust policies are needed to foster market development.

Countries like the UAE and South Africa are at the forefront of this emerging market, investing in military modernization and infrastructure. The competitive landscape is still developing, with a few key players beginning to establish a presence. As the region seeks to enhance its military capabilities, the demand for fiber optic solutions is expected to grow, albeit at a slower pace compared to other regions.