Research Methodology on Fire Protection Coatings Market

Introduction:

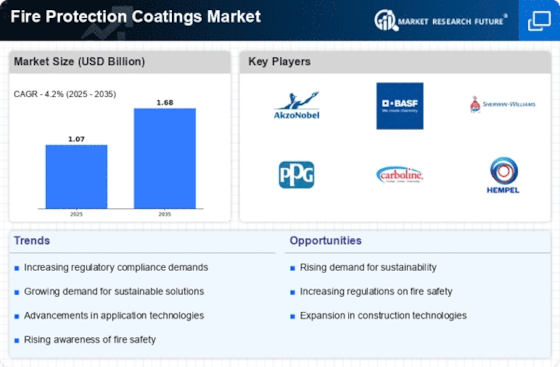

Fire protection coatings are applied on the surface of various materials to improve the fire resistance of the material. Such coatings are primarily used in the construction, automotive and industrial sectors, wherever there is a need to protect the materials or metals from the damages caused by fire or heat. Increasing industrialization and growing demand for fire protection systems, in various sectors, have led to a growth in the fire protection coatings market, worldwide.

Research Objectives:

The main focus of the following research is to analyze the market size and trends, existing and potential opportunities, and the impact of the COVID-19 pandemic on the Fire Protection Coatings industry for the forecast period of 2024-2032. Thus, the objectives of the study are:

- To analyze the current size and trends of the global Fire Protection Coatings market

- To assess the impact of the COVID-19 pandemic on the growth of the Fire Protection Coatings market

- To analyze the potential opportunities in the Fire Protection Coatings market

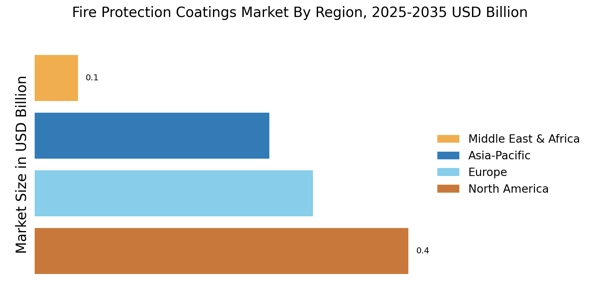

- To forecast the segmental growth of the Fire Protection Coatings market

Research Methodology:

For this research study, a mixed methodology is adopted that combines both qualitative and quantitative approaches. The primary research approach is employed to collect data from industry experts and stakeholders. The secondary research approach is used to gather data from existing and available secondary sources such as reports, journals, industry reports, etc.

Primary Research:

The primary research method is preferred to gather information from industry sources. This method uses surveys, interviews, and Focused Group Discussions (FGDs) and helps to gain insights from the stakeholders and industry experts. The primary research for this study includes interviews and discussions with key industry personnel such as manufacturers, suppliers, dealers and distributors, government, NGOs and consulting firms. Through interviews, information is gathered on current market size, market dynamics, and recent developments.

Secondary Research:

Secondary research is a key part of this research process and includes various research sources such as journal articles, press releases, company reports, and trade and industry databases. Furthermore, these reports are also consulted to gain an accurate picture of the Fire Protection Coatings market and its present as well as future trends.

Data Analysis:

The data is analyzed by keeping in mind the objectives of the study. The study involves the use of descriptive and inferential statistical analysis. Descriptive statistics are used to study and appreciate the market, whereas inferential statistics are used for forecasting the market value. Market assessment techniques such as Porter’s Five Forces Model, SWOT analysis, and PESTEL analysis will be employed to get a comprehensive view of the Fire Protection Coatings market.

Conclusion:

The Fire Protection Coatings market is likely to witness healthy growth in the forecast period 2023 to 2030 owing to the growth across several end-user industries such as construction and can be positively impacted by the rising investments from governments and other organizations in fire safety projects. This research aims to provide a comprehensive assessment of the Fire Protection Coatings market, in terms of size and trends, as well as the impact of COVID-19. The qualitative and quantitative research approaches will aid in capturing the insights of the industry players and the consumers.