Rising Demand for Seafood

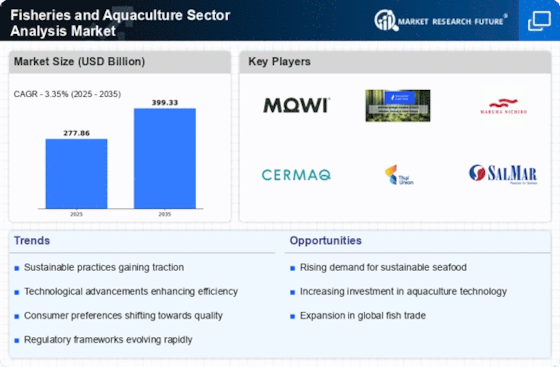

The Fisheries and Aquaculture Sector Analysis Market is experiencing a notable increase in the demand for seafood products. This trend is driven by a growing population and a shift towards healthier dietary preferences. According to recent data, seafood consumption has risen by approximately 20% over the last decade, indicating a robust market potential. As consumers become more health-conscious, the preference for protein sources such as fish and shellfish is likely to continue. This rising demand compels stakeholders in the Fisheries and Aquaculture Sector Analysis Market to enhance production capabilities and explore sustainable sourcing methods to meet consumer expectations.

Sustainability Initiatives

Sustainability has emerged as a critical driver within the Fisheries and Aquaculture Sector Analysis Market. Stakeholders are increasingly adopting practices that minimize environmental impact and promote resource conservation. The implementation of sustainable fishing practices and responsible aquaculture methods is not only beneficial for ecosystems but also aligns with consumer preferences for ethically sourced products. Reports indicate that a significant portion of consumers is willing to pay a premium for sustainably sourced seafood. This trend suggests that sustainability initiatives could enhance brand loyalty and market share for companies operating within the Fisheries and Aquaculture Sector Analysis Market.

Consumer Awareness and Education

Consumer awareness regarding the benefits of seafood consumption is a significant driver in the Fisheries and Aquaculture Sector Analysis Market. Educational campaigns highlighting the nutritional advantages of fish, such as omega-3 fatty acids, are fostering a more informed consumer base. As awareness grows, consumers are more likely to seek out seafood products, thereby increasing market demand. Furthermore, initiatives aimed at educating consumers about sustainable fishing practices are likely to influence purchasing decisions. This heightened awareness could lead to a more robust market for sustainably sourced seafood within the Fisheries and Aquaculture Sector Analysis Market.

Regulatory Frameworks and Compliance

The Fisheries and Aquaculture Sector Analysis Market is influenced by evolving regulatory frameworks aimed at ensuring sustainable practices and food safety. Governments are implementing stricter regulations regarding fishing quotas, aquaculture practices, and environmental protection. Compliance with these regulations is essential for market participants to avoid penalties and maintain operational licenses. As regulatory scrutiny increases, companies that proactively adapt to these changes may gain a competitive advantage. This dynamic indicates that the regulatory landscape will continue to shape the operational strategies of businesses within the Fisheries and Aquaculture Sector Analysis Market.

Innovations in Aquaculture Technology

Technological advancements are playing a pivotal role in shaping the Fisheries and Aquaculture Sector Analysis Market. Innovations such as recirculating aquaculture systems (RAS) and automated feeding systems are enhancing productivity and sustainability. These technologies not only improve fish growth rates but also reduce environmental impacts. For instance, RAS can increase yield by up to 30% while minimizing water usage. As these technologies become more accessible, they are likely to attract investments and drive growth within the Fisheries and Aquaculture Sector Analysis Market, enabling producers to meet the increasing demand for seafood.