Market Analysis

In-depth Analysis of Flexible Display Technology Market Industry Landscape

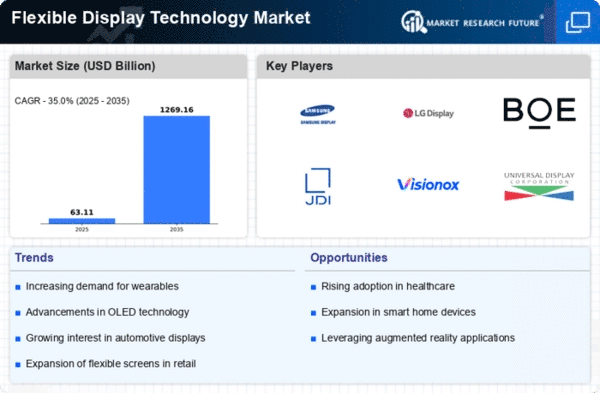

In recent years, the flexible display technology market has exploded as a large player in the global electronics industry. The pervasive trend of smartphones, tablets and wearable devices combining flexible displays is one major source of power for this expansion. They are giving consumers the opportunity to carry bendable folding or roll-up screens in their pockets. The need for sleek, lightweight and portable devices has led to the integration of flexible displays in all manner of electronics. Manufacturers also love to create contemporary devices featuring advanced technology, or ones with an innovative and beautiful design. This has prompted investment in research and development so that companies can come up with flexible display technologies which are highly durable, as well as yielding vibrant images of high resolution. Moreover, the competitive environment among major industry players exerts a strong influence on market dynamics. With regard to product innovation, cost-efficiency and market share as a whole companies compete with each other. As a result, the development of new flexible display technologies has continued unabated. From OLED (Organic Light Emitting Diode) to E-Paper and beyond, each is fighting for supremacy on the market. It's a competitive world that benefits consumers by providing them with more choice and it pressures manufacturers to improve the quality of workmanship and thus functionality. On the other hand, economic bad times may affect consumer spending habits and distort the growth path of this market. Furthermore, changes in the prices of raw materials (such as polymers and conductive substances used for flexible displays) can affect production costs or market trends. As well, new developments in technology also add to the market's dynamism. As a result of continued R & D efforts, breakthroughs are achieved which raise the level up to that point attainable for flexible displays making them applicable beyond consumer electronics in many industrial areas. With applications extending into the automotive dashboard, medical devices and clothing beyond traditional boundaries; flexible displays are often seen in these fields.

Leave a Comment