Increased Focus on Cybersecurity

In the Flight Management Systems (FMS) and Stable Market, the increased focus on cybersecurity is emerging as a vital driver. As FMS become more interconnected and reliant on digital technologies, the risk of cyber threats escalates. Airlines and manufacturers are prioritizing the implementation of robust cybersecurity measures to protect sensitive data and ensure operational integrity. Recent reports indicate that investments in aviation cybersecurity are projected to grow by 25% over the next five years. This heightened emphasis on cybersecurity not only safeguards the industry but also stimulates demand for advanced FMS solutions, thereby propelling growth in the Flight Management Systems (FMS) and Stable Market.

Rising Demand for Fuel Efficiency

In the Flight Management Systems (FMS) and Stable Market, the rising demand for fuel efficiency is a critical driver. Airlines are increasingly pressured to minimize operational costs and reduce their carbon footprint. FMS technologies play a vital role in optimizing flight paths and managing fuel consumption effectively. Recent studies indicate that airlines utilizing advanced FMS can achieve up to 10% fuel savings per flight. This growing emphasis on sustainability and cost-effectiveness is prompting airlines to upgrade their FMS, thereby fostering growth in the Flight Management Systems (FMS) and Stable Market.

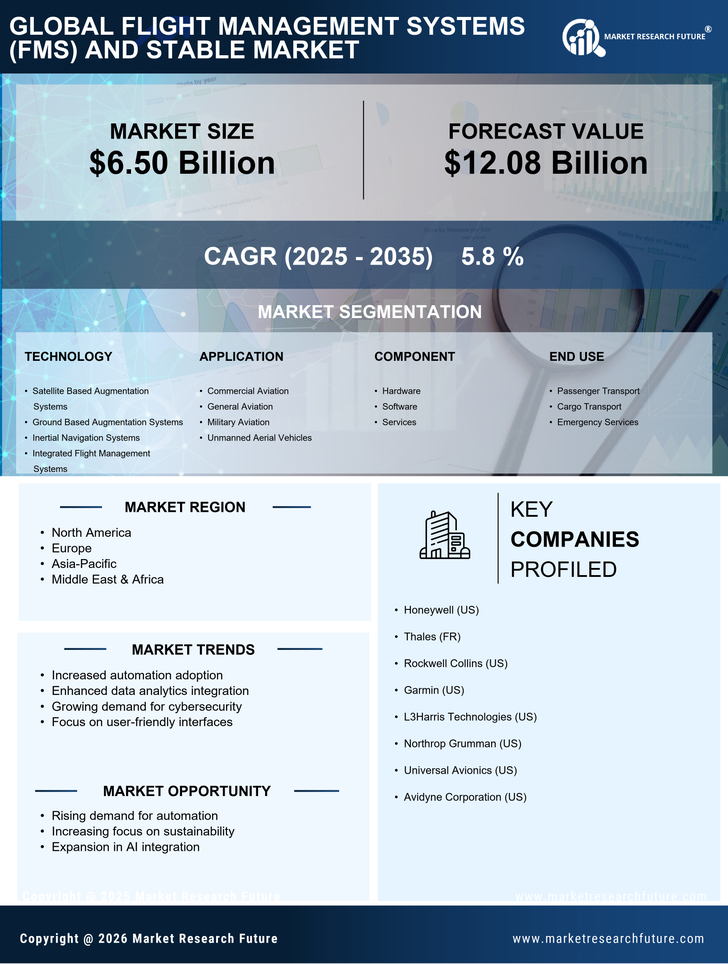

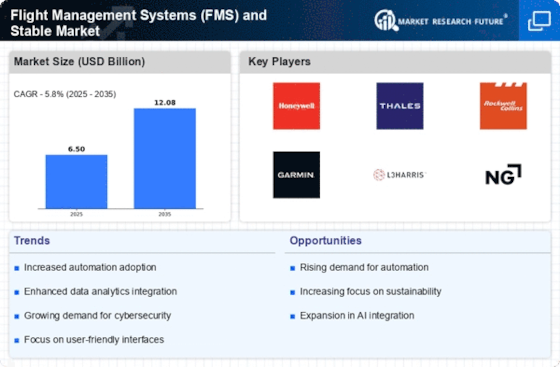

Technological Advancements in Aviation

The Flight Management Systems (FMS) and Stable Market is currently experiencing a surge in technological advancements. Innovations such as artificial intelligence and machine learning are being integrated into FMS, enhancing operational efficiency and safety. These technologies allow for real-time data processing and predictive analytics, which can significantly reduce flight delays and improve fuel efficiency. According to recent data, the adoption of advanced FMS technologies is projected to increase by 15% annually, indicating a robust growth trajectory. This trend not only streamlines flight operations but also contributes to cost savings for airlines, making it a pivotal driver in the Flight Management Systems (FMS) and Stable Market.

Regulatory Compliance and Safety Standards

The Flight Management Systems (FMS) and Stable Market is heavily influenced by stringent regulatory compliance and safety standards. Governments and aviation authorities worldwide are continuously updating regulations to enhance safety and operational efficiency. Compliance with these regulations often necessitates the adoption of advanced FMS technologies that can meet the required safety benchmarks. For instance, the implementation of the latest safety protocols has led to a 20% reduction in aviation incidents over the past five years. This regulatory landscape compels airlines to invest in modern FMS solutions, thereby driving growth in the Flight Management Systems (FMS) and Stable Market.

Expansion of Air Travel and Fleet Modernization

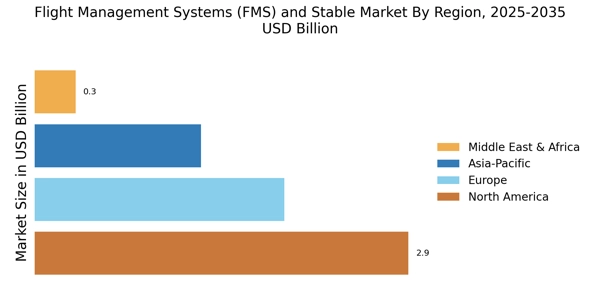

The Flight Management Systems (FMS) and Stable Market is benefiting from the expansion of air travel and fleet modernization. As passenger numbers continue to rise, airlines are compelled to expand their fleets and modernize existing aircraft to accommodate this growth. This expansion often involves the integration of state-of-the-art FMS that enhance navigation and operational capabilities. Data suggests that the global fleet of commercial aircraft is expected to grow by 4% annually, driving demand for advanced FMS solutions. Consequently, this trend is a significant contributor to the growth of the Flight Management Systems (FMS) and Stable Market.