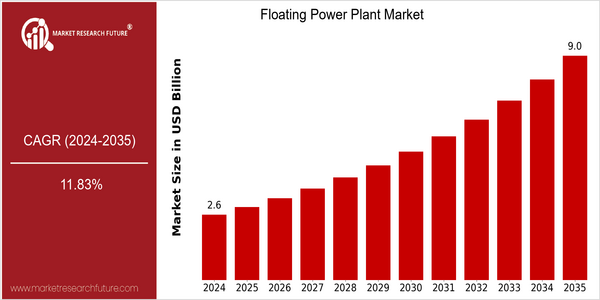

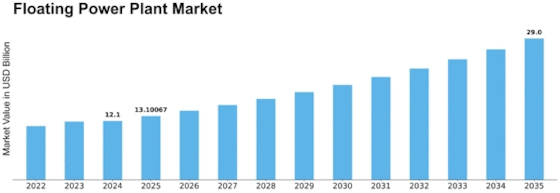

Floating Power Plant Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 2.63 Billion |

| 2035 | USD 9.0 Billion |

| CAGR (2025-2035) | 11.83 % |

Note – Market size depicts the revenue generated over the financial year

The floating power plant market is expected to reach a size of $ 2.63 billion by 2024, and is expected to reach $ 9.0 billion by 2035. This growth represents a strong CAGR of 11.83% from 2025 to 2035. The demand for renewable energy sources and the development of floating technology are the main reasons for this market expansion. As countries strive to meet their energy needs sustainably, floating power plants can be used in various marine environments, thereby increasing energy access and security. The government's support for the reduction of carbon emissions and the resulting policy support will also drive the market. The market's major players, such as rsted, Siemens Gamesa, and General Electric, are actively investing in research and development, establishing strategic partnerships, and launching new products to take advantage of this market growth. The recent offshore wind power projects of rsted, for example, show that it is developing in this direction and will strengthen its position in this evolving market.

Regional Market Size

Regional Deep Dive

Floating Power Plants Market is gaining traction in several regions, driven by the rising demand for green energy sources and the need for flexible power generation solutions. North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America are the key regions where the market is growing. Each region has its own set of opportunities and challenges, which depend on the regulations, economic conditions, and the cultural acceptance of renewable energy.

Europe

- Norway and the Netherlands are in the forefront of this development, which is being pushed forward by projects like the Hywind Tampen, which is aiming to power offshore oil platforms with wind energy.

- The European Union's Green Deal and its commitment to achieving carbon neutrality by 2050 are driving investments in floating power plants, encouraging collaboration among key players like Siemens Gamesa and Vattenfall.

Asia Pacific

- China is rapidly advancing its floating solar power initiatives, with projects like the floating solar farm in Huainan, which is one of the largest in the world, showcasing the region's commitment to renewable energy.

- Japan's government is promoting floating offshore wind projects, with companies like Marubeni Corporation leading efforts to develop floating wind farms, supported by favorable regulatory frameworks.

Latin America

- Brazil is emerging as a key player in the floating power plant market, with projects focusing on floating solar technology to address energy shortages in remote areas, supported by government incentives.

- Chile is also exploring floating wind farms, with the government actively promoting renewable energy projects to diversify its energy mix and reduce reliance on fossil fuels.

North America

- The U.S. Department of Energy has launched initiatives to support the development of floating offshore wind farms, which are expected to play a crucial role in the transition to renewable energy, particularly along the East Coast.

- Companies like Ørsted and Equinor are actively investing in floating power plant technologies, with projects such as the Ocean Wind and Hywind developments, which are set to enhance energy production capabilities in the region.

Middle East And Africa

- The Middle East is exploring floating solar power as a solution to its energy needs, with projects like the Mohammed bin Rashid Al Maktoum Solar Park in Dubai, which aims to integrate floating solar technology.

- In Africa, countries like South Africa are investigating floating power plants to harness their vast water bodies for renewable energy generation, supported by initiatives from organizations like the African Development Bank.

Did You Know?

“Floating power plants can reduce the environmental impact of energy generation by utilizing water bodies that are often underutilized, potentially generating power without occupying valuable land.” — International Renewable Energy Agency (IRENA)

Segmental Market Size

Floating Power Plants play a crucial role in the offshore and wind-power sector, especially in harnessing offshore wind and solar energy. This market is currently experiencing a growth spurt, driven by the need for ever-greater supplies of energy and the demand for sustainable solutions. Among the main reasons for this is the global trend towards de-carbonization, which is putting increasing pressure on energy supplies, especially in regions where there is a shortage of land for conventional power plants. Floating Power Plants are currently in the pilot-stage of implementation, with projects such as the Hywind Scotland, developed by the Norwegian company, Equinor, showing the way forward. These power plants are mainly used in the offshore energy sector, supplying clean energy to coastal communities and industries. Government initiatives to increase the use of renewable energy and the implementation of sustainable development programmes are also driving growth in this sector. The development of floating platforms and energy storage solutions is also shaping the future of this market, making it more efficient at harnessing and distributing energy.

Future Outlook

Floating power plants will grow from $2.63 billion in 2024 to $ 9 billion in 2035, with a CAGR of 11.83%. The growing demand for energy from renewable sources, especially in regions with scarce land for generating electricity, will drive this growth. Floating power plants are becoming a viable solution for the transition to sustainable energy. In 2035, floating power plants could represent up to 15 to 20 percent of the global renewable energy capacity, which will show their growing importance in the energy mix. Improved technology, such as improved floating platform designs and higher energy conversion efficiencies, will also stimulate the market. Supportive government policies, such as the promotion of renewable energy and the implementation of support schemes, will also play an important role in the development of floating power plants. Besides, the trend of combining energy storage systems and hybrid solutions will also lead to new developments. Floating power plants will become a major element in future energy strategies.

Leave a Comment