Rising Water Treatment Needs

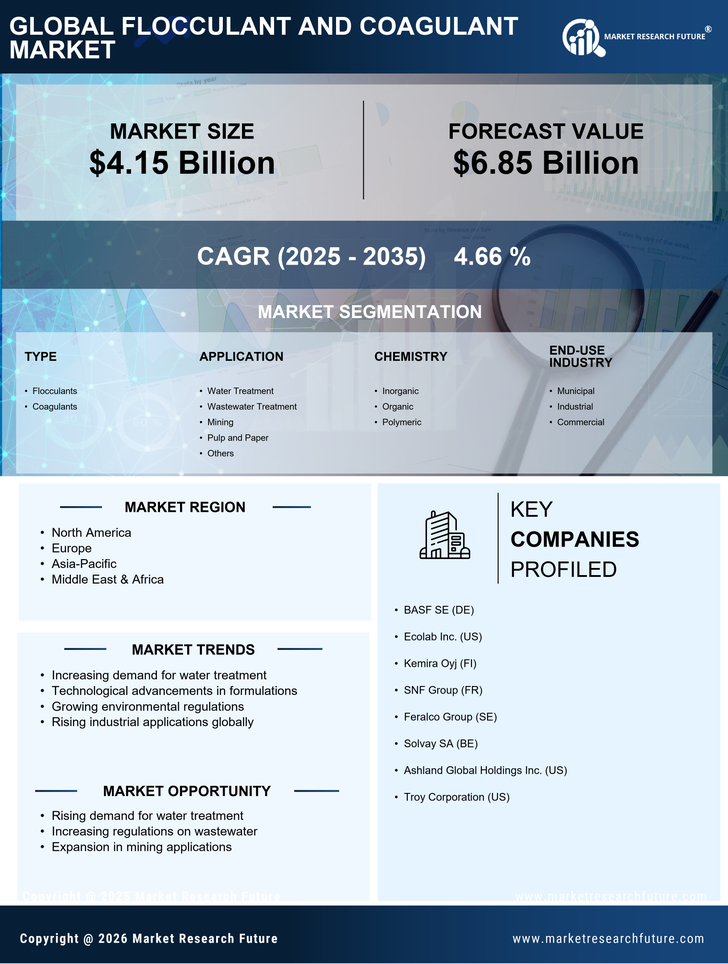

The increasing demand for clean water is a primary driver for the Flocculant and Coagulant Market. As urbanization accelerates, the need for effective water treatment solutions becomes more pressing. According to recent data, the water treatment sector is projected to grow significantly, with flocculants and coagulants playing a crucial role in removing impurities and contaminants. This growth is further fueled by industrial activities that require stringent water quality standards. The Flocculant and Coagulant Market is thus positioned to benefit from this trend, as municipalities and industries alike seek efficient solutions to meet regulatory requirements and public health standards.

Agricultural Practices and Soil Management

The agricultural sector's reliance on effective soil management techniques is a significant driver for the Flocculant and Coagulant Market. As farmers seek to improve soil quality and enhance crop yields, the use of flocculants and coagulants in irrigation and soil stabilization becomes more prevalent. These substances aid in the aggregation of soil particles, improving water retention and nutrient availability. Recent studies suggest that the adoption of these products in agriculture is on the rise, reflecting a growing awareness of sustainable farming practices. Consequently, the Flocculant and Coagulant Market is likely to experience increased demand as agricultural stakeholders prioritize soil health.

Industrial Growth and Wastewater Management

The expansion of various industries, including mining, food processing, and pharmaceuticals, drives the Flocculant and Coagulant Market. These sectors generate substantial amounts of wastewater that require treatment before discharge. The increasing focus on sustainable practices and environmental compliance has led to a heightened demand for flocculants and coagulants, which facilitate the removal of suspended solids and other pollutants. Market data indicates that the wastewater treatment segment is expected to witness robust growth, thereby enhancing the prospects for the Flocculant and Coagulant Market. Companies are increasingly investing in advanced treatment technologies, further propelling market demand.

Technological Innovations in Water Treatment

Advancements in technology are reshaping the Flocculant and Coagulant Market. Innovations in chemical formulations and application methods enhance the efficiency and effectiveness of these products in water treatment processes. For instance, the development of bio-based flocculants is gaining traction, appealing to environmentally conscious consumers and industries. Furthermore, automated dosing systems are being integrated into treatment facilities, optimizing the use of flocculants and coagulants. Market data suggests that these technological advancements are likely to drive growth in the Flocculant and Coagulant Market, as stakeholders seek to improve operational efficiency and reduce environmental impact.

Emerging Economies and Infrastructure Development

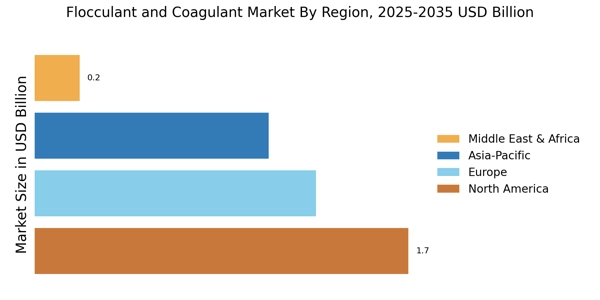

The rapid development of infrastructure in emerging economies serves as a catalyst for the Flocculant and Coagulant Market. As these regions invest in water supply systems, sewage treatment plants, and industrial facilities, the need for effective water treatment solutions becomes paramount. The construction of new facilities often necessitates the use of flocculants and coagulants to ensure compliance with environmental regulations. Market analysis indicates that infrastructure projects in these economies are expected to grow, thereby driving demand for water treatment chemicals. This trend presents a substantial opportunity for the Flocculant and Coagulant Market to expand its footprint in these burgeoning markets.