Sustainability Focus

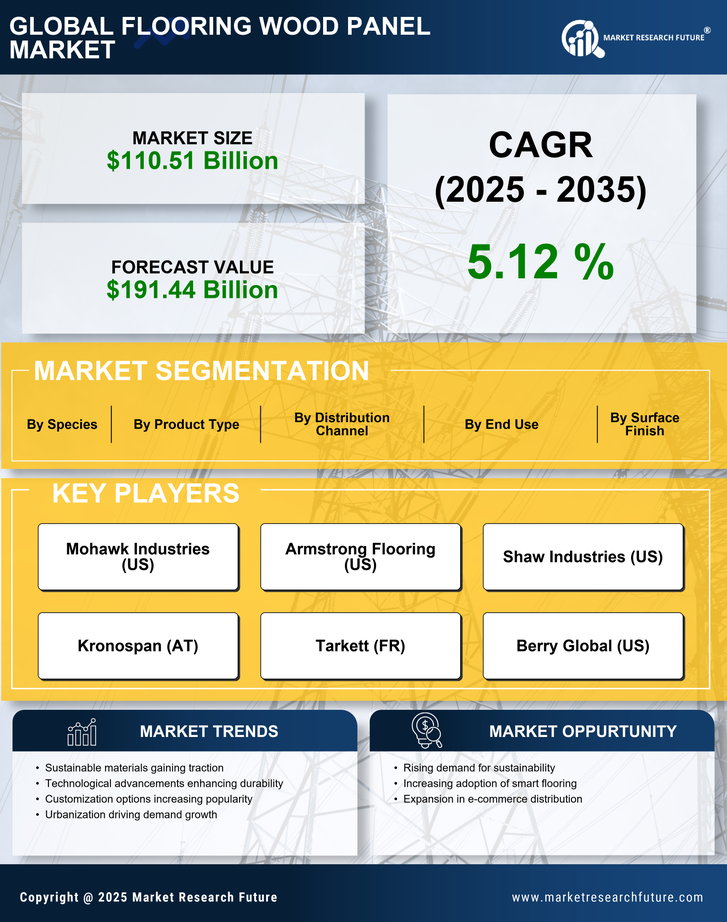

The Flooring Wood Panel Market is increasingly influenced by a growing emphasis on sustainability. Consumers are becoming more environmentally conscious, leading to a heightened demand for eco-friendly flooring options. This trend is reflected in the rising popularity of wood panels sourced from sustainably managed forests. According to recent data, the market for sustainable wood products is projected to grow at a compound annual growth rate of approximately 6% over the next five years. Manufacturers are responding by adopting sustainable practices, such as using reclaimed wood and low-VOC finishes, which not only appeal to eco-conscious consumers but also comply with stringent environmental regulations. This shift towards sustainability is likely to reshape the Flooring Wood Panel Market, as companies that prioritize eco-friendly products may gain a competitive edge.

Technological Advancements

Technological advancements are playing a crucial role in shaping the Flooring Wood Panel Market. Innovations in manufacturing processes, such as improved milling techniques and enhanced finishing technologies, are leading to higher quality products with better durability and aesthetics. For instance, the introduction of digital printing technology allows for intricate designs and patterns to be applied to wood panels, expanding design possibilities. Additionally, the integration of smart technologies into flooring solutions, such as moisture sensors and temperature control systems, is gaining traction. Market data suggests that the adoption of smart flooring solutions could increase by over 15% in the coming years. These technological advancements not only enhance product offerings but also improve operational efficiencies, positioning companies favorably within the Flooring Wood Panel Market.

Customization and Personalization

Customization and personalization are becoming pivotal drivers in the Flooring Wood Panel Market. As consumers seek unique and tailored solutions for their homes and commercial spaces, manufacturers are increasingly offering customizable wood panel options. This trend is supported by data indicating that nearly 40% of consumers are willing to pay a premium for personalized products. The ability to choose specific wood types, finishes, and designs allows consumers to express their individual styles, thereby enhancing customer satisfaction. Furthermore, advancements in manufacturing technologies enable quicker production times for customized orders, making it feasible for companies to meet this growing demand. As a result, the Flooring Wood Panel Market is likely to see a surge in offerings that cater to the desire for personalized flooring solutions.

Economic Growth and Consumer Spending

Economic growth and consumer spending are pivotal factors influencing the Flooring Wood Panel Market. As economies recover and expand, disposable incomes are rising, leading to increased consumer spending on home improvement and renovation projects. Market data reveals that the home improvement sector is projected to grow by approximately 5% annually, with flooring being a key area of investment. Consumers are increasingly willing to invest in high-quality wood panels that enhance the aesthetic appeal and value of their properties. Additionally, the rise of e-commerce platforms has made it easier for consumers to access a variety of flooring options, further driving sales in the Flooring Wood Panel Market. This positive economic outlook suggests a favorable environment for growth in the flooring sector.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are significant drivers impacting the Flooring Wood Panel Market. As urban areas expand and new residential and commercial projects emerge, the demand for flooring solutions, particularly wood panels, is on the rise. Data indicates that urban populations are expected to increase by over 2 billion by 2050, leading to a surge in construction activities. This growth presents opportunities for manufacturers to supply wood panels for various applications, including residential homes, offices, and retail spaces. Furthermore, government initiatives aimed at promoting sustainable urban development are likely to bolster the demand for eco-friendly flooring options. Consequently, the Flooring Wood Panel Market is poised to benefit from the ongoing urbanization trends and infrastructure investments.