Sustainability Initiatives

Sustainability initiatives are becoming increasingly relevant in the Fluid Dispensing Equipment For Semiconductors Electronic Market. Manufacturers are under pressure to adopt environmentally friendly practices, which includes the use of sustainable materials and processes in fluid dispensing. The industry is witnessing a shift towards eco-friendly dispensing solutions that minimize waste and energy consumption. Companies are exploring biodegradable materials and solvent-free adhesives, which align with global sustainability goals. This trend is likely to influence purchasing decisions, as customers prioritize suppliers that demonstrate a commitment to sustainability. As a result, the demand for innovative fluid dispensing equipment that supports these initiatives is expected to rise.

Technological Advancements

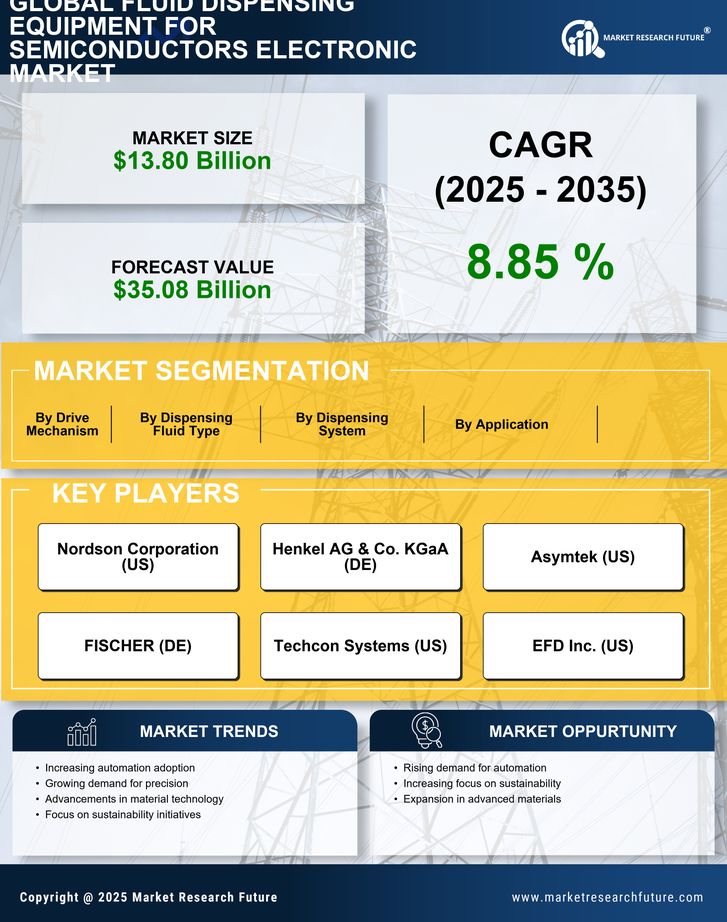

The Fluid Dispensing Equipment For Semiconductors Electronic Market is experiencing rapid technological advancements that enhance precision and efficiency in fluid dispensing processes. Innovations such as micro-dispensing and advanced robotics are being integrated into equipment, allowing for more accurate application of materials. This is particularly crucial in semiconductor manufacturing, where the demand for miniaturization and high-performance components is increasing. According to recent data, the market for fluid dispensing equipment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these technological improvements. As manufacturers seek to optimize production processes, the adoption of cutting-edge fluid dispensing technologies is likely to become a key differentiator in the competitive landscape.

Customization and Versatility

Customization and versatility are essential drivers in the Fluid Dispensing Equipment For Semiconductors Electronic Market. As semiconductor applications become more diverse, the need for adaptable dispensing solutions is paramount. Manufacturers are increasingly seeking equipment that can accommodate a wide range of materials and dispensing techniques. This trend is reflected in the growing market for modular dispensing systems that can be tailored to specific production requirements. The ability to customize dispensing parameters not only enhances operational efficiency but also allows for the production of specialized semiconductor components. Consequently, the demand for versatile fluid dispensing equipment is likely to continue to grow as manufacturers seek to optimize their production capabilities.

Rising Demand for Semiconductors

The Fluid Dispensing Equipment For Semiconductors Electronic Market is significantly influenced by the rising demand for semiconductors across various sectors, including automotive, consumer electronics, and telecommunications. As industries increasingly rely on advanced semiconductor technologies, the need for efficient fluid dispensing solutions becomes paramount. The semiconductor market is expected to reach a valuation of over 600 billion dollars by 2025, which directly correlates with the growth of fluid dispensing equipment. This surge in demand necessitates the development of more sophisticated dispensing systems that can handle a variety of materials and applications, thereby driving innovation and investment in the fluid dispensing sector.

Increased Focus on Quality Control

Quality control remains a critical driver in the Fluid Dispensing Equipment For Semiconductors Electronic Market. As semiconductor manufacturers strive to meet stringent quality standards, the precision of fluid dispensing processes becomes essential. Equipment that ensures consistent application and minimizes defects is in high demand. The industry is witnessing a shift towards automated quality assurance systems that integrate with dispensing equipment, allowing for real-time monitoring and adjustments. This focus on quality not only enhances product reliability but also reduces waste and operational costs. As a result, manufacturers are increasingly investing in advanced fluid dispensing technologies that support rigorous quality control measures.