Fluorescent Lighting Market Summary

As per Market Research Future analysis, the Fluorescent Lighting Market Size was estimated at 7.995 USD Billion in 2024. The fluorescent lighting industry is projected to grow from 8.753 USD Billion in 2025 to 21.66 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.48% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Fluorescent Lighting Market is experiencing a transformative shift towards energy efficiency and smart technology integration.

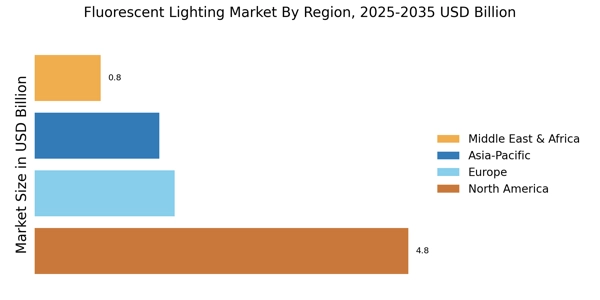

- North America remains the largest market for fluorescent lighting, driven by robust demand in the residential segment.

- Asia-Pacific is emerging as the fastest-growing region, propelled by rapid urbanization and infrastructure development.

- The residential segment continues to dominate the market, while the commercial segment is witnessing the fastest growth due to increasing demand for smart lighting solutions.

- Technological advancements and regulatory support are key drivers, fostering energy conservation and sustainability initiatives across both new installations and retrofits.

Market Size & Forecast

| 2024 Market Size | 7.995 (USD Billion) |

| 2035 Market Size | 21.66 (USD Billion) |

| CAGR (2025 - 2035) | 9.48% |

Major Players

Philips (NL), Osram (DE), GE Lighting (US), Cree (US), Panasonic (JP), Sylvania (US), Toshiba (JP), Signify (NL), Feit Electric (US)