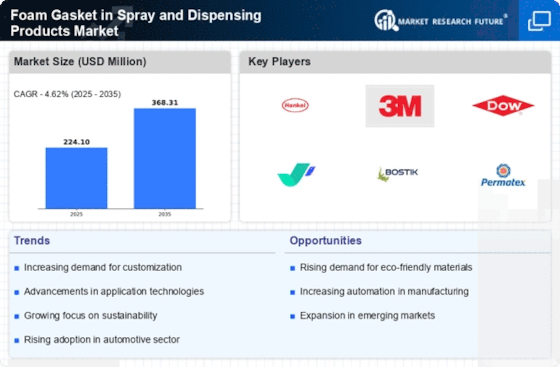

The global foam gasket in the pump and spray dispensing products market is characterized by the presence of many regional and local players. The market is highly competitive, with all the players continually competing to gain a larger market share. Foam gaskets play a vital role in providing cushioning, sealing and vibration damping in pumps and spray dispensing products that are used in a wide range of industries such as automotive, agriculture, packaging, healthcare, cosmetics and many more. In these products, foam gaskets are used for creating seals between the components for preventing leaks and ensuring efficient operations.Also, foam gaskets can be integrated in the spray nozzles for creating a seal between the container and the nozzle in order to prevent leakage. Moreover, in some spray dispensing products, foam gaskets are used for regulating and controlling the pressure. All these benefits offered by foam gaskets make it an important compound required for proper functioning of pumps and spray dispensing products, owing to which its demand is anticipated to grow significantly.

Rubber Concept: Rubber Concept is engaged in the manufacturing of a variety of polymer and rubber components. The company’s product portfolio includes wide array of products, sone of which includes gaskets, rubber roller, rubber seal, rubber molded articles, foam products, sheets & mats, acoustic products, plastic products, and silicone rubber products. The company manufactures foam gaskets with the help of precision dies that are made on CNC controlled machines in order to control the tight tolerances. It further offers gaskets of varied density, shape, thickness and hardness, suitable for various applications.The company has developed over 150 varieties of rubber formulations from nitrile rubber (NBR, Buna-N), silicone rubber, FKM (Viton) rubber, and chloroprene (Neoprene) rubber, and many more. The industries served by the company include printing, pumps and motors, packaging, textile, irrigation, electrical, food processing, automation, chemical pharmaceutical, cement, and construction.Custom Gasket Manufacturing LLC: Custom Gasket Manufacturing LLC specializes in producing seals, gaskets and insulating products. It offers custom die cut gaskets, molded rubber products, rubber extrusions, rubber gaskets & seals, sponge rubber extrusion and valve cover gaskets. Company’s offerings find significant applications in industries such as power generation, lighting, transportation, filtration, food processing, pump & valve and electronics. It provides gaskets of various material types such as rubber, closed cell sponge rubber, open cell sponge rubber, compressed non -asbestos materials, cork, electrical insulation materials, foam, and fiber, plastic, among others.Moreover, the company also provides waterjet cutting services, laser cutting services and flash cutting services for several industrial applications.

Foam Gasket in Spray and Dispensing Products Industry Developments

July 2023: In July 2023, C.B. Frost & Co. Ltd invested in strengthening its production facility by introducing the die cutting formes manufacturing services. The company used to partner with Flexi-formesas its supplier for die cutting forms that are used for cutting gaskets in different shapes and sizes. By manufacturing die cutting formes in house, company is reducing its dependency on suppliers for the products that are crucial for producing the company’s offerings.

May 2023: In May 2023, C.B. Frost & Co. Ltd invested in the new Samco 70 Series Beam cutting press for enhancing its production capabilities providing speedy delivery of its products to the customers. The aim of this investment is to chieve excellent speed as well as precision for cutting the materials in the form of sheets, strips and gaskets. Also, by using tis equipment the production coats will be reduced significantly allowing the company to provide the products at reasonable costs.