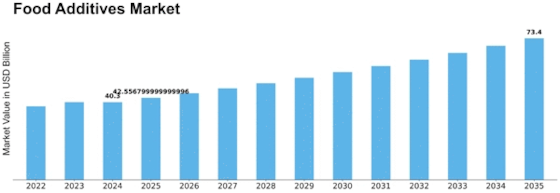

Food Additives Size

Food Additives Market Growth Projections and Opportunities

The Food Additives Market is influenced by a diverse set of factors that collectively shape its dynamics and growth patterns. One of the primary drivers is the global trend of increasing processed and convenience food consumption. As lifestyles become busier, consumers seek ready-to-eat and easy-to-prepare food options, driving the demand for food additives. These additives, including preservatives, flavor enhancers, and colorants, play a crucial role in extending shelf life, improving taste, and enhancing the visual appeal of processed foods.

Technological advancements and innovation within the food industry contribute significantly to the Food Additives Market. Continuous research and development lead to the discovery of new and improved food additives that address consumer demands for healthier and more natural alternatives. Manufacturers are investing in innovative solutions to meet regulatory requirements while providing products that align with consumer preferences for clean label and minimally processed foods.

Globalization and the interconnectedness of markets play a pivotal role in shaping the Food Additives Market. The ease of transportation and international trade allows for the widespread distribution of food products, leading to a global exchange of food additives. This globalization not only increases the variety of available additives but also exposes consumers to diverse culinary experiences, influencing preferences and choices in different regions.

Consumer awareness and demand for clean label products are emerging as influential factors in the Food Additives Market. Increasingly, consumers are scrutinizing food labels and avoiding products with synthetic or artificial additives. This has led to a growing preference for natural additives derived from plant or animal sources. Manufacturers are responding by developing clean label products that meet the demand for transparency and simplicity in ingredient lists.

Government regulations and policies related to food safety, labeling, and permissible additives are integral market factors. The Food and Drug Administration (FDA) and other regulatory bodies worldwide set standards for the use of food additives to ensure consumer safety. Compliance with these regulations is crucial for manufacturers to gain and maintain market access, as well as to establish trust with consumers.

The rise of health-conscious consumers and their increasing focus on the nutritional content of food products contribute to the dynamics of the Food Additives Market. Consumers are seeking foods with added health benefits, leading to the incorporation of functional additives such as vitamins, minerals, and probiotics. The market responds by offering products that not only enhance taste and appearance but also contribute to overall health and well-being.

Economic factors, including income levels and consumer spending patterns, play a role in shaping the Food Additives Market. Economic prosperity often correlates with increased spending on processed and convenience foods, driving the demand for additives. Conversely, economic downturns may influence consumer choices, impacting the market for certain premium or specialty additives.

The retail landscape and distribution channels also influence the Food Additives Market. The availability of food additives in supermarkets, grocery stores, and online platforms contributes to their accessibility and market reach. Effective marketing strategies, including product placement and educational campaigns, are crucial for manufacturers to communicate the benefits and usage of food additives to consumers.

Environmental and sustainability considerations are gaining prominence in the Food Additives Market. As awareness of environmental issues grows, consumers are increasingly looking for sustainable and eco-friendly alternatives. Manufacturers are exploring green technologies and eco-friendly packaging options to align with consumer preferences for environmentally conscious choices.

Leave a Comment