Increased Regulatory Scrutiny

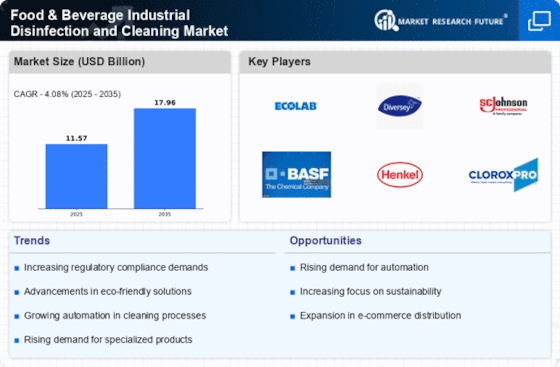

The Food & Beverage Industrial Disinfection and Cleaning Market is significantly influenced by the increasing regulatory scrutiny surrounding food safety and hygiene practices. Regulatory bodies are imposing stricter guidelines and standards to ensure that food and beverage products are safe for consumption. This has led to a surge in demand for effective disinfection and cleaning solutions that comply with these regulations. Companies are now required to implement comprehensive cleaning protocols and maintain detailed records of their cleaning activities. The market for industrial cleaning products is projected to grow as businesses invest in compliant cleaning solutions to avoid penalties and maintain their operational licenses. This regulatory environment is likely to drive innovation and the development of new cleaning technologies within the Food & Beverage Industrial Disinfection and Cleaning Market, as companies strive to meet evolving standards.

Rising Demand for Hygiene Standards

The Food & Beverage Industrial Disinfection and Cleaning Market is experiencing a notable increase in demand for stringent hygiene standards. This trend is driven by heightened consumer awareness regarding food safety and the potential health risks associated with contamination. As a result, food and beverage companies are investing significantly in advanced disinfection and cleaning solutions to ensure compliance with safety regulations. The market for industrial cleaning chemicals is projected to reach approximately USD 30 billion by 2026, indicating a robust growth trajectory. Companies are increasingly adopting comprehensive cleaning protocols, which include the use of eco-friendly disinfectants, to enhance their brand reputation and consumer trust. This shift towards higher hygiene standards is likely to propel the Food & Beverage Industrial Disinfection and Cleaning Market further, as businesses prioritize cleanliness to maintain operational integrity.

Expansion of Food and Beverage Industry

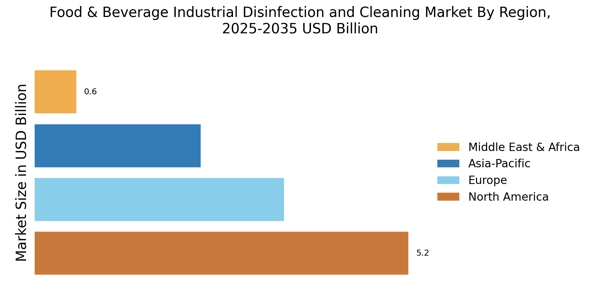

The expansion of the food and beverage industry is a critical driver for the Food & Beverage Industrial Disinfection and Cleaning Market. As the global population continues to grow, the demand for food products is increasing, leading to the establishment of new food processing facilities and restaurants. This expansion necessitates robust cleaning and disinfection protocols to ensure food safety and quality. The food service sector alone is projected to grow at a CAGR of 4.5% through 2028, which will subsequently boost the demand for industrial cleaning solutions. Companies are investing in comprehensive cleaning systems to maintain hygiene standards and comply with regulations. This growth in the food and beverage sector is likely to create substantial opportunities for the Food & Beverage Industrial Disinfection and Cleaning Market, as businesses prioritize cleanliness to protect their reputation and consumer health.

Consumer Preference for Eco-Friendly Products

There is a growing consumer preference for eco-friendly cleaning products within the Food & Beverage Industrial Disinfection and Cleaning Market. As awareness of environmental issues increases, consumers are demanding sustainable and biodegradable cleaning solutions that minimize ecological impact. This shift is prompting food and beverage companies to adopt greener cleaning practices, which not only align with consumer values but also enhance brand loyalty. The market for green cleaning products is expected to witness substantial growth, with estimates suggesting it could reach USD 10 billion by 2027. Companies are increasingly formulating their cleaning products with natural ingredients, reducing harmful chemicals, and promoting their sustainability efforts. This trend towards eco-friendliness is likely to shape the future of the Food & Beverage Industrial Disinfection and Cleaning Market, as businesses seek to differentiate themselves in a competitive landscape.

Technological Innovations in Cleaning Equipment

Technological advancements are playing a pivotal role in shaping the Food & Beverage Industrial Disinfection and Cleaning Market. Innovations such as automated cleaning systems, advanced sanitization technologies, and IoT-enabled devices are enhancing the efficiency and effectiveness of cleaning processes. For instance, the integration of robotics in cleaning operations allows for consistent and thorough disinfection, reducing human error and labor costs. The market for cleaning equipment is expected to grow at a CAGR of around 6% over the next few years, driven by these technological innovations. Furthermore, the adoption of smart cleaning solutions enables real-time monitoring and data analytics, which can optimize cleaning schedules and resource allocation. As companies seek to improve operational efficiency and reduce costs, the Food & Beverage Industrial Disinfection and Cleaning Market is likely to benefit from these technological advancements.