Versatility in Food Applications

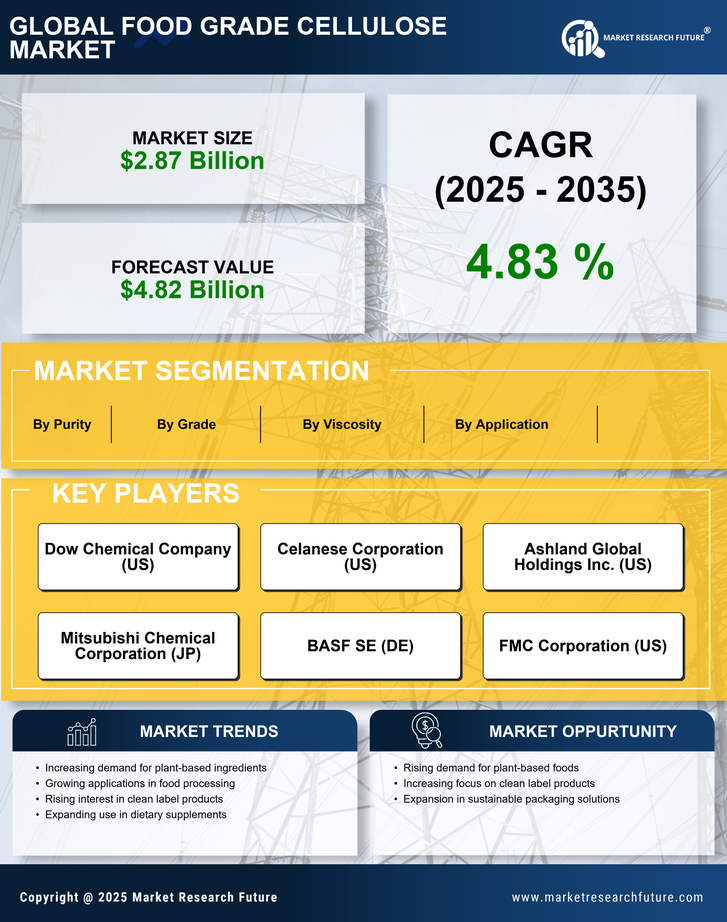

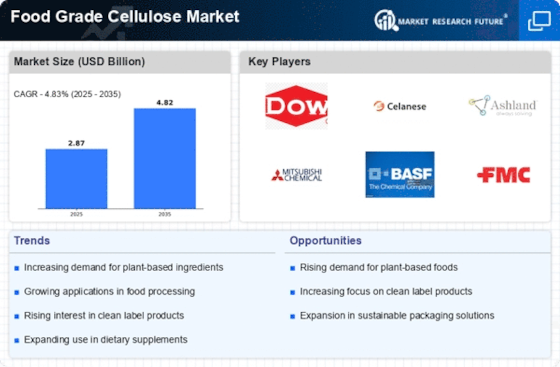

The versatility of food grade cellulose in a myriad of food applications is a significant driver for the Food Grade Cellulose Market. This ingredient is employed in a wide range of products, including baked goods, dairy items, and meat substitutes, due to its ability to improve texture, stability, and moisture retention. Market analysis suggests that the food grade cellulose segment is projected to grow at a compound annual growth rate of 12% over the next five years, driven by its multifunctional properties. As food manufacturers seek to enhance product quality and consumer appeal, the demand for food grade cellulose is likely to expand, further solidifying its role in diverse food formulations.

Health Consciousness Among Consumers

The increasing health consciousness among consumers appears to be a pivotal driver for the Food Grade Cellulose Market. As individuals become more aware of the nutritional content of their food, there is a growing preference for products that are perceived as healthier. Food grade cellulose, known for its low-calorie content and high fiber properties, is increasingly utilized in various food products to enhance texture and provide bulk without adding calories. This trend is reflected in market data, which indicates that the demand for food products containing food grade cellulose has risen by approximately 15% over the past year. Consequently, manufacturers are incorporating food grade cellulose into their formulations to cater to this health-oriented consumer base.

Regulatory Support for Food Additives

Regulatory frameworks supporting the use of food additives, including food grade cellulose, are likely to bolster the Food Grade Cellulose Market. Authorities in various regions have established guidelines that endorse the safety and efficacy of food grade cellulose as a food additive. This regulatory backing not only reassures manufacturers but also encourages innovation in product development. For instance, the approval of food grade cellulose in various food applications has led to an estimated market growth of 10% annually. As regulations continue to evolve, the food grade cellulose market is expected to benefit from increased acceptance and utilization in food products, thereby enhancing its market presence.

Rising Popularity of Plant-Based Diets

The rising popularity of plant-based diets is emerging as a crucial driver for the Food Grade Cellulose Market. As more consumers adopt vegetarian and vegan lifestyles, there is an increasing demand for plant-based food products that often incorporate food grade cellulose for texture and binding. This trend is supported by market data indicating that the plant-based food sector has experienced a growth rate of approximately 20% in recent years. Food grade cellulose serves as an essential ingredient in these products, providing the necessary structure and mouthfeel that consumers expect. Consequently, the food grade cellulose market is likely to see sustained growth as the demand for plant-based alternatives continues to rise.

Technological Advancements in Food Processing

Technological advancements in food processing techniques are likely to propel the Food Grade Cellulose Market forward. Innovations such as improved extraction methods and processing technologies have enhanced the quality and functionality of food grade cellulose. These advancements enable manufacturers to produce food grade cellulose that meets specific consumer needs, such as enhanced solubility and improved sensory attributes. Market projections indicate that the food processing sector is expected to grow by 8% annually, with food grade cellulose playing a vital role in this evolution. As food manufacturers increasingly adopt these technologies, the demand for high-quality food grade cellulose is anticipated to rise, further driving market growth.