Rising Demand for Livestock Feed

The Forage Harvester Market is significantly influenced by the rising demand for livestock feed, which is driven by the growing global population and increasing meat consumption. As the need for high-quality forage increases, farmers are investing in advanced harvesting equipment to ensure optimal feed quality and quantity. Recent statistics indicate that the livestock sector is projected to grow, leading to a corresponding rise in forage production. This trend suggests that the demand for efficient and effective forage harvesting solutions will continue to escalate. Consequently, manufacturers in the Forage Harvester Market are likely to focus on developing equipment that enhances feed quality while also improving harvesting efficiency, thereby addressing the needs of a burgeoning livestock industry.

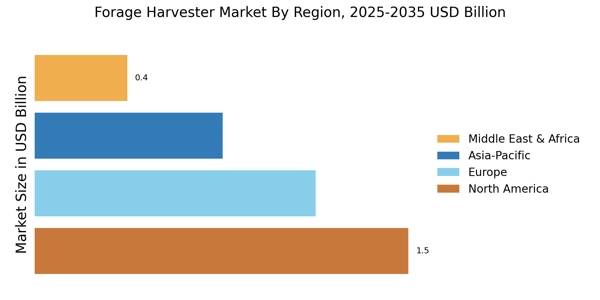

Economic Growth and Agricultural Investment

Economic growth in various regions is positively impacting the Forage Harvester Market, as increased agricultural investment leads to enhanced farming practices. As economies develop, there is a noticeable uptick in the adoption of modern agricultural technologies, including advanced forage harvesting equipment. This trend is particularly evident in emerging markets, where investments in agriculture are being prioritized to boost food security and productivity. Data suggests that regions experiencing economic expansion are also seeing a rise in the purchase of high-efficiency forage harvesters. This correlation indicates that as economic conditions improve, the Forage Harvester Market is likely to benefit from increased sales and innovation in harvesting technologies.

Consumer Preferences for High-Quality Forage

Consumer preferences are shifting towards high-quality forage, which is significantly impacting the Forage Harvester Market. As consumers become more health-conscious, the demand for premium livestock products has surged, necessitating the production of superior forage. This trend compels farmers to invest in advanced harvesting technologies that ensure the quality of the forage is maintained from field to feed. The market is witnessing a growing interest in forage varieties that offer better nutritional value, which in turn influences harvesting practices. Manufacturers in the Forage Harvester Market are responding by developing equipment that not only enhances harvesting efficiency but also preserves the quality of the forage, thereby aligning with consumer demands for high-quality agricultural products.

Sustainability and Environmental Considerations

Sustainability is becoming a central theme within the Forage Harvester Market, driven by increasing awareness of environmental issues. Farmers and agricultural businesses are increasingly seeking equipment that minimizes environmental impact while maximizing efficiency. The demand for sustainable practices is reflected in the growing interest in bioenergy crops and organic farming, which require specialized harvesting techniques. Additionally, regulations aimed at reducing carbon footprints are influencing equipment design and operational practices. The market for eco-friendly forage harvesters is expected to expand as manufacturers innovate to meet these sustainability goals. This shift not only aligns with consumer preferences but also positions the Forage Harvester Market favorably in a landscape increasingly focused on environmental stewardship.

Technological Advancements in Forage Harvesting

The Forage Harvester Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as precision agriculture, automation, and advanced data analytics are enhancing the efficiency and productivity of forage harvesting equipment. For instance, the integration of GPS technology allows for more accurate field mapping and crop monitoring, which can lead to improved yield outcomes. Furthermore, the adoption of autonomous forage harvesters is on the rise, potentially reducing labor costs and increasing operational efficiency. According to recent data, the market for precision agriculture tools is projected to grow significantly, indicating a strong correlation with the demand for advanced forage harvesting solutions. This trend suggests that as technology continues to evolve, the Forage Harvester Market will likely see increased investment and development in high-tech harvesting equipment.