Enhanced Regulatory Frameworks

The establishment of stringent regulatory frameworks aimed at reducing greenhouse gas emissions is a pivotal driver for the Forestry and Landuse Carbon Credit Market. Governments are increasingly implementing policies that mandate emissions reductions, thereby creating a structured environment for carbon trading. For instance, the introduction of cap-and-trade systems in various regions has incentivized companies to invest in carbon credits derived from forestry and land use projects. This regulatory push not only fosters market stability but also encourages innovation in carbon capture and storage technologies, further propelling the industry's growth.

Corporate Sustainability Commitments

The growing trend of corporate sustainability commitments is significantly influencing the Forestry and Landuse Carbon Credit Market. Many corporations are pledging to achieve net-zero emissions by specific target years, which necessitates the acquisition of carbon credits to offset their emissions. In 2025, it is estimated that over 70% of Fortune 500 companies will have integrated carbon credit purchases into their sustainability strategies. This shift not only drives demand for carbon credits but also encourages investment in sustainable forestry practices, thereby enhancing the overall health of ecosystems and contributing to biodiversity conservation.

Public Awareness and Consumer Pressure

Public awareness regarding environmental issues is increasingly pressuring companies to adopt sustainable practices, thereby impacting the Forestry and Landuse Carbon Credit Market. Consumers are becoming more discerning, favoring brands that demonstrate a commitment to environmental stewardship. This shift in consumer behavior is prompting businesses to invest in carbon credits as part of their corporate social responsibility initiatives. As a result, the market is experiencing a notable increase in demand for carbon credits, with projections indicating a potential growth rate of 15% annually over the next five years. This trend underscores the importance of aligning business practices with consumer expectations in the evolving landscape of sustainability.

Increasing Demand for Carbon Offsetting

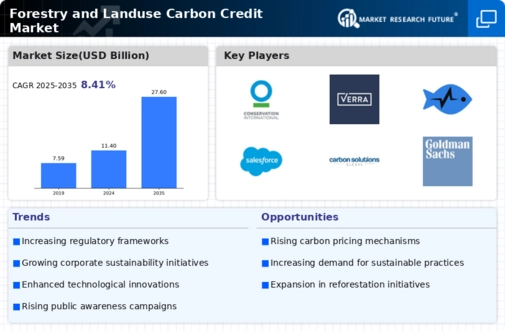

The rising awareness of climate change has led to an increasing demand for carbon offsetting solutions. Organizations across various sectors are actively seeking ways to mitigate their carbon footprints, which has resulted in a surge in participation in the Forestry and Landuse Carbon Credit Market. In 2025, the market is projected to reach a valuation of approximately 10 billion USD, driven by corporate sustainability initiatives and consumer preferences for environmentally responsible practices. This trend indicates a robust growth trajectory for the industry, as more companies commit to net-zero emissions targets and invest in carbon credits to fulfill their environmental obligations.

Technological Advancements in Carbon Measurement

Technological advancements in carbon measurement and monitoring are transforming the Forestry and Landuse Carbon Credit Market. Innovations such as remote sensing, satellite imagery, and blockchain technology are enhancing the accuracy and transparency of carbon credit verification processes. These technologies facilitate more efficient tracking of carbon sequestration efforts, thereby increasing trust among stakeholders. As a result, the market is witnessing a rise in the issuance of verified carbon credits, which is expected to bolster investor confidence and attract more participants to the industry. This trend suggests a promising future for carbon credit trading as technology continues to evolve.