FPSO Market Summary

As per MRFR Analysis, the FPSO Market is projected to grow significantly, driven by increased offshore oil and gas exploration and production. The market size was estimated at 7.42 USD Billion in 2024 and is expected to reach 11.29 USD Billion by 2034, with a CAGR of approximately 4.7% from 2025 to 2035. The demand for FPSOs is fueled by the depletion of onshore resources and the need for cost-effective solutions in deepwater drilling. Major players are investing in R&D and strategic partnerships to enhance their market presence.

Key Market Trends & Highlights

The FPSO market is witnessing robust growth due to several key trends.

- FPSO Market Size in 2024: USD 6.83 Billion; Expected to reach USD 11.29 Billion by 2035.

- CAGR from 2025 to 2034: Approximately 4.7%; driven by increased offshore exploration.

- Converted FPSOs account for 58% of market revenue; offering cost-effective solutions.

- Major National Oil Companies (NOCs) dominate the market with 58% revenue share.

Market Size & Forecast

2024 Market Size: USD 7.42 Billion

2025 Market Size: USD 7.68 Billion

2035 Market Size: USD 11.29 Billion

CAGR (2025-2035): 12.50%

Major Players

Key players include MODEC Inc, Bluewater Energy Services B.V., Malaysia International Shipping Corporation Berhe, Mitsui Engineering and Shipbuilding, MOL Group, Marubeni Corporation, Aker Floating Production Group, BW Offshore, Maersk, Bumi Armada Berhad, Yinson Holdings Berhad, SBM Offshore N.V., Petrofac, Teekay Corporation.

The increasing demand for oil and gas and growing focus on discovering new offshore reserves are driving the growth of the FPSO Market.

As per the Analyst at MRFR, the global FPSO (Floating Production, Storage, and Offloading) market is driven by increasing offshore oil and gas exploration activities, particularly in deepwater and ultra-deepwater regions, where traditional fixed platforms are not feasible. The market is further bolstered by the rising demand for energy, technological advancements in FPSO designs, and the need for cost-effective, flexible solutions for remote oil production.

However, challenges such as high initial capital costs, regulatory hurdles, and environmental concerns act as restraints on market growth. Opportunities for the FPSO market lie in the growing trend of subsea tiebacks, the expansion of FPSO applications to new markets, and advancements in green technologies, including carbon capture and storage (CCS).

FIGURE 1: FPSO MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

FPSO Market Opportunity

Deepwater And Ultra-Deepwater Exploration

The global Floating Production Storage and Offloading (FPSO) market is significantly influenced by advancements in deepwater and ultra-deepwater exploration. As the demand for oil and gas continues to grow, oil companies are increasingly turning to offshore exploration, particularly in deepwater and ultra-deepwater regions, to access new reserves.

Deepwater refers to areas of the sea that are typically deeper than 500 meters (1,640 feet), while ultra-deepwater refers to depths greater than 1,500 meters (4,920 feet). These areas are seen as the future of the offshore oil and gas industry, as conventional onshore or shallow water reserves are depleting. As a result, companies are focusing their efforts on tapping into these vast, untapped resources located in difficult-to-reach depths.

FPSOs are crucial in facilitating the extraction of oil and gas from these deepwater and ultra-deepwater environments. These units are floating vessels that are designed to process and store hydrocarbons produced offshore, and they can be stationed in waters too deep for traditional fixed platforms. The flexibility and mobility of FPSOs make them ideal for exploration in remote or difficult locations, such as the Brazilian pre-salt fields, the Gulf of Mexico, and offshore West Africa.

FPSOs can be deployed in deepwater and ultra-deepwater fields to accommodate the growing need for oil and gas production while providing a solution for storage and transportation without the need for expensive subsea pipelines. Moreover, FPSOs are advantageous in locations where infrastructure is limited or where environmental conditions are harsh. The FPSO Market is set to benefit from continued investments in exploration activities, as FPSOs become a primary method for accessing resources in these challenging environments.

FPSO Market Segment Insights

FPSO by Water Depth Insights

Based on Water Depth, the FPSO market is segmented into: Shallow water, Deep water, Ultra-deep water. The Deep-water segment dominated the global market in 2024, while the Shallow water segment is projected to be the fastest–growing segment during the forecast period. The deep-water segment of the FPSO Market encompasses offshore oil and gas fields located at water depths ranging from 400 meters to 1,500 meters. These FPSOs are designed to operate in more challenging environments compared to shallow water FPSOs, as they are exposed to stronger currents, harsher weather conditions, and greater technical challenges in terms of construction, installation, and maintenance.

Due to the higher cost of operations and advanced technology required, deep water FPSOs tend to be larger, more complex, and technologically sophisticated. They often feature enhanced systems for subsea production and storage and are deployed in regions with significant reserves but no immediate access to land-based facilities. The deep water FPSO segment is a key driver of growth in offshore oil and gas production, with countries like Brazil, the Gulf of Mexico, and parts of West Africa representing major hubs for such developments.

FPSO by Construction Type Insights

Based on Construction Type, the FPSO market is segmented into: Converted, New build, Redeployed. The Converted segment dominated the global market in 2024, while the New build segment is projected to be the fastest–growing segment during the forecast period Converted Floating Production Storage and Offloading (FPSO) units refer to existing ships or tankers that are retrofitted for use as offshore production facilities. Typically, these conversions are performed on decommissioned oil tankers or cargo ships, which are repurposed to produce, process, and store oil and gas extracted from offshore fields.

The conversion process involves significant modifications, including the installation of production equipment, living quarters, and other systems needed for offshore operations. Converted FPSOs are often more cost-effective compared to building new units, as they utilize existing structures. This segment of the FPSO market is particularly popular in regions where oil companies need to reduce upfront costs or where there is a shortage of specialized shipyards for new builds.

FPSO by Hull Type Insights

Based on Hull Type, the FPSO market is segmented into: Single hull, Double hull. The Single hull segment dominated the global market in 2024, while the Single hull segment is projected to be the fastest–growing segment during the forecast period. A Single Hull FPSO (Floating Production, Storage, and Offloading unit) is a traditional design, consisting of a single hull structure where production facilities are located on the deck, and storage tanks are integrated within the hull. This type of FPSO is typically more vulnerable to environmental risks, such as oil spills and ship collisions, due to the lack of a second protective layer.

Single hull FPSOs are more cost-effective in terms of construction and maintenance compared to double hull units, making them attractive for projects in less demanding environments. However, many single hull FPSOs are being phased out due to stricter environmental regulations and a growing emphasis on safety and sustainability in offshore oil and gas operations. As a result, the demand for single hull FPSOs is decreasing in favor of double hull designs.

FIGURE 2: FPSO MARKET SHARE BY HULL TYPE 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

FPSO by Propulsion Insights

Based on Propulsion, the FPSO market is segmented into: Self-propelled, Towed. The Self-propelled segment dominated the global market in 2024, while the Towed segment is projected to be the fastest–growing segment during the forecast period. Self-propelled Floating Production Storage and Offloading (FPSO) units are designed to be able to move under their own power, without relying on tugboats or external assistance.

These FPSOs are equipped with engines, thrusters, and a dynamic positioning system (DPS) that allows them to maintain their position while in operation, and sometimes even to reposition themselves in response to changing conditions or requirements. This capability makes them highly versatile, especially for projects in deepwater or remote offshore locations where tethering to fixed platforms is not feasible. Self-propelled FPSOs are particularly useful in fields with short-to-medium life spans or in regions where relocating the unit might be necessary for exploration or production optimization.

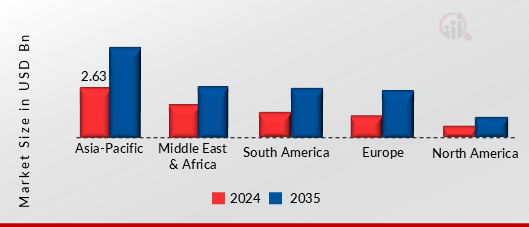

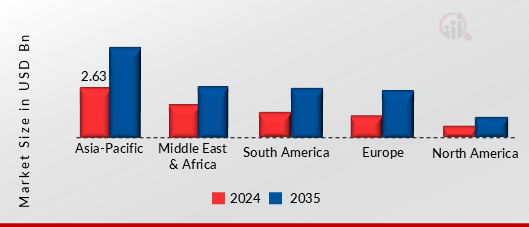

FPSO Regional Insights

Based on the Region, the global FPSO is segmented into North America, Europe, Asia-Pacific, South America and Middle East & Africa. The Asia-Pacific dominated the global market in 2024, while the South America is projected to be the fastest–growing segment during the forecast period. Major demand factors driving the Asia Pacific market are the Asia Pacific region is witnessing rapid growth in the FPSO market, driven by increasing offshore exploration and production activities in countries like China, India, Malaysia, Indonesia, and Australia. Asia's offshore oil and gas reserves are vast, and the demand for FPSO units is fueled by the region's shift toward deepwater exploration, particularly in countries like Malaysia and Indonesia, where deepwater fields are abundant.

Australia, with its major gas and oil projects in the Timor Sea and offshore Western Australia, is a significant contributor to the region's FPSO market. Moreover, Asia Pacific is seeing a rise in offshore gas developments, which are expected to further drive FPSO adoption for liquefied natural gas (LNG) production. The region's growing energy demand and investment in offshore infrastructure are pivotal in the expansion of the FPSO market.

FIGURE 3: FPSO MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, UK, Norway, China, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Angola, Congo, Egypt, Equatorial Guinea, Gabon, Ghana, Libyan Arab Jamahiriya, Mauritania, Nigeria, South Africa, Tunisia, Brazil and others.

Global FPSO Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the FPSO Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major competitors in the market are Yinson Holdings BERHAD, MODEC, Inc, Misc Group, Bumi Armada BERHAD, BW Offshore Limited, Petrovietnam Technical Services Corporation (PTSC), Altera Infrastructure, Bluewater Energy Services, Hyundai Heavy Industries, SBM Offshore are among others. The FPSO Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the FPSO Market include

- Yinson Holdings BERHAD

- MODEC, Inc

- Misc Group

- Bumi Armada BERHAD

- BW Offshore Limited

- Petrovietnam Technical Services Corporation (PTSC)

- Altera Infrastructure

- Bluewater Energy Services

- Hyundai Heavy Industries

- SBM Offshore

FPSO Market Industry Developments

April 2024: SBM Offshore announced that ExxonMobil Guyana Limited has confirmed the award of contracts for the Whiptail development project located in the Stabroek Block in Guyana. Under these contracts, SBM Offshore will construct and install FPSO Jaguar. Ownership will transfer to EMGL prior to the FPSO’s installation in Guyana, and SBM Offshore expects to operate the FPSO for 10 years under the Operations and Maintenance Enabling Agreement signed in 2023. The award follows completion of front-end engineering and design studies, receipt of requisite government approvals and the final investment decision on the project by ExxonMobil and block co-venturers.

September 2023: Altera Infrastructure announced that an operations and maintenance contract with Equinor for the Petrojarl Knarr FPSO has now become effective. This vessel is set for deployment on the Rosebank field with a nine-year firm contract, and options extending up to 25 years. This follows the final investment decision by Equinor and Ithaca Energy to advance the Rosebank development on the UK Continental Shelf and builds upon the previously announced bareboat charter contract for the redeployment of the FPSO.

February 2022: South Korea’s Hyundai Heavy Industries was selected to fabricate the hull and living quarters for the P-78 floating production, storage and offloading vessel destined for Petrobras’ Buzios field offshore Brazil.

March 2022: Bluewater announced that its affiliate Bluewater (Aoka Mizu) B.V., the owner of the Aoka Mizu FPSO, has signed a contract with Hurricane GLA Limited, the UK based oil and gas company and operator of the Lancaster Field, for an extension to the Bareboat Charter beyond the current expiry date of 4 June 2022.

FPSO Market Segmentation

FPSO by Water Depth Outlook

- Shallow water

- Deep water

- Ultra-deep water

FPSO by Construction Type Outlook

- Converted

- New build

- Redeployed

FPSO by Hull Type Outlook

FPSO by Propulsion Outlook

FPSO Regional Outlook

-

North America

-

Europe

-

Asia-Pacific

- China

- India

- Australia

- New Zealand

- Indonesia

- Malaysia

- Philippines

- Thailand

- Vietnam

-

South America

-

Middle East & Africa

- Angola

- Congo

- Egypt

- Equatorial Guinea

- Gabon

- Ghana

- Libyan Arab Jamahiriya

- Mauritania

- Nigeria

- South Africa

- Tunisia

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

USD 7.42 Billion

|

|

Market Size 2025

|

USD 7.68 Billion

|

|

Market Size 2035

|

USD 11.29 Billion

|

|

Compound Annual Growth Rate (CAGR)

|

4.7% (2025-2035)

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Historical Data

|

2019-2023

|

|

Forecast Units

|

Value (USD Billion)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Segments Covered

|

By Water Depth, By Construction Type, By Hull Type, By Propulsion

|

|

Geographies Covered

|

North America, Europe, Asia Pacific, South America, Middle East & Africa

|

|

Countries Covered

|

The US, Canada, Mexico, UK, Norway, China, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Angola, Congo, Egypt, Equatorial Guinea, Gabon, Ghana, Libyan Arab Jamahiriya, Mauritania, Nigeria, South Africa, Tunisia, Brazil

|

|

Key Companies Profiled

|

Yinson Holdings BERHAD, MODEC, Inc, Misc Group, Bumi Armada BERHAD, BW Offshore Limited, Petrovietnam Technical Services Corporation (PTSC), Altera Infrastructure, Bluewater Energy Services, Hyundai Heavy Industries, SBM Offshore

|

|

Key Market Opportunities

|

· Deepwater and Ultra-Deepwater Exploration

· Rising demand for crude oil and natural gas

|

|

Key Market Dynamics

|

· Increasing Demand for Oil and Gas

· Growing focus on discovering new offshore reserves

|

Frequently Asked Questions (FAQ) :

USD 7.42 Billion is the FPSO Market in 2024

The Converted segment by Construction Type holds the largest market share and grows at a CAGR of 4.6% during the forecast period.

Asia-Pacific holds the largest market share in the FPSO Market.

Yinson Holdings BERHAD, MODEC, Inc, Misc Group, Bumi Armada BERHAD, BW Offshore Limited, Petrovietnam Technical Services Corporation (PTSC), Altera Infrastructure, Bluewater Energy Services, Hyundai Heavy Industries, SBM Offshore are prominent players in the FPSO Market.

The Single hull segment dominated the market in 2024.