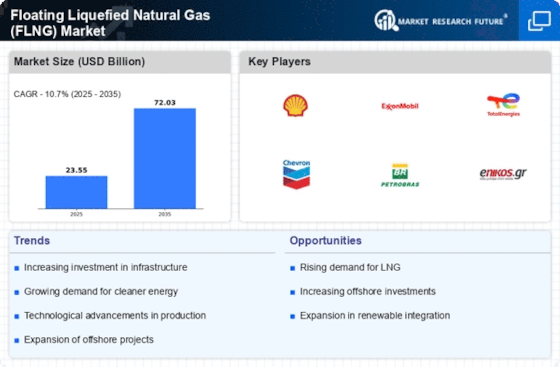

The Floating liquefied natural gas Market (FLNG) Market is offering a wide range of advanced and efficient floating liquefied natural gas (FLNG) products are the growing demand across various applications. This market is segmented by floating liquefied natural gas (FLNG) technology, capacity, and region. Key drivers of market growth include the rising adoption of floating liquefied natural gas (FLNG)s in sectors like Natural Gas Production, Marginal Gas Fields, Gas-to-Power Projects, and Emergency Gas Supply.

Furthermore, the Floating liquefied natural gas Market (FLNG) Market is dominated by major players such as ABB Ltd, Woodside Energy Group Ltd, Petroliam Nasional Berhad (PETRONAS), EXMAR, Hoegh

LNG, Shell plc, Excelerate Energy, Inc., BASF SE, Golar LNG Limited, Mitsui O.S.K.Lines, and Eni S.p.A. These companies’ or players have a strong worldwide or the global presence and offer an different floating liquefied natural gas (FLNG) technology, including Small/Mid-Scale and Large Scale application needs.

They comapnies differentiate on factors like, quality, reliability, and innovation and cost effectiveness. They promote research and development activities and help in the introduction new floating liquefied natural gas (FLNG) technologies which help in expanding their product portfolios . They follow or adopt initiatives like mergers, acquisitions, partnerships, and collaborations with other industry participants to achieve the market share. The Floating liquefied natural gas Market (FLNG) Market has also felt the impact of the COVID-19 pandemic, leading to fluctuations in demand in various end-user sectors and supply chain disruptions.

However, as the global economy gradually recovers, the market is expected to rebound, driven by the growing reliance on floating liquefied natural gas (FLNG)s in essential technologies and the increasing emphasis on sustainability. The market's future prospects are promising, with floating liquefied natural gas (FLNG)s set to play a pivotal role in the ongoing technological transformations and innovations, making them an integral component of the evolving global industrial landscape.

ABB Ltd.: ABB Ltd. is a Swiss-Swedish corporation that produces electrical equipment products. It was established by the merger of Asea from Sweden and Brown, Boveri & Cie from Switzerland, both of whom were large electrical goods & engineering companies in their countries, simplified from Asea Brown Boveri to ABB. It has four business area: Electrification, Motion, Process Automation and Robotics & Discrete Automation along with 19 divisions.

The core values the company holds dear are courage, care, curiosity & collaboration, through which they have managed to keep their lead in the electrical goods market. Their aim is to be an enabler for a sustainable & resource-efficient future with their lead in electrification & automation. Until the year 2020, it was Switzerland’s largest employer.

Petroliam Nasional Berhad: PETROLIAM NASIONAL BERHAD (PETRONAS) established in 1974, is a key player in the Exploitation of Oil And Gas sector in KUALA LUMPUR, Malaysia. This LIMITED BY SHARES, PUBLIC LIMITED entity, with a detailed company profile available, features a robust structure with 10 directors and 2 shareholders. The comprehensive company profile includes the shareholding structure, a list of shareholders and directors, records of charges, and, when available, the latest financial statements, reflecting the company's transparency and commitment to industry excellence.