Expansion of LNG Infrastructure

The expansion of LNG infrastructure is a crucial factor influencing the Liquefied Natural Gas (LNG) Carrier Market. Investments in LNG terminals, regasification facilities, and storage capacities are increasing, facilitating the seamless transportation and distribution of LNG. As of 2025, the number of operational LNG terminals worldwide has risen significantly, with over 200 terminals in operation. This expansion not only enhances the logistical capabilities of LNG carriers but also supports the growing demand for LNG in emerging markets. Furthermore, the development of new shipping routes and the enhancement of existing ones are likely to optimize the supply chain, making LNG more accessible and affordable. Consequently, the infrastructure growth is expected to drive the LNG carrier market, ensuring that supply meets the rising global demand.

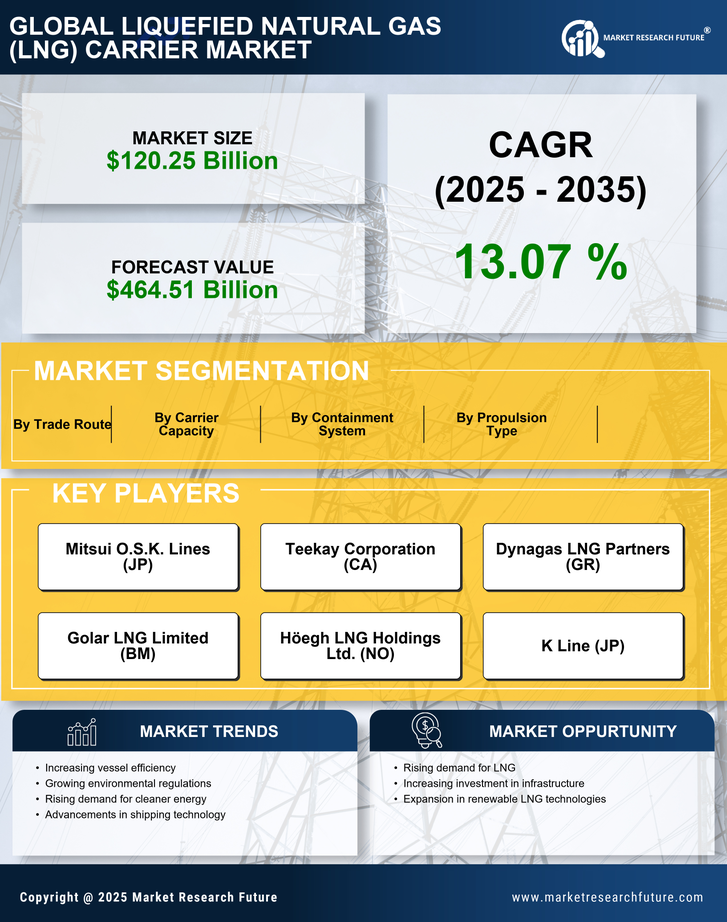

Rising Investments in LNG Projects

Rising investments in LNG projects are a significant driver for the Liquefied Natural Gas (LNG) Carrier Market. As countries and companies recognize the potential of LNG as a cleaner energy alternative, substantial capital is being allocated to develop new LNG production facilities and expand existing ones. In 2025, it is projected that global investments in LNG projects will exceed USD 200 billion, reflecting a robust commitment to this sector. This influx of capital not only supports the construction of LNG carriers but also enhances the overall supply chain, ensuring that LNG can be transported efficiently to meet growing demand. The financial backing for LNG projects is likely to stimulate innovation and improve the competitiveness of LNG in the energy market, further propelling the carrier market.

Geopolitical Dynamics and Energy Security

Geopolitical dynamics significantly impact the Liquefied Natural Gas (LNG) Carrier Market. As countries seek to diversify their energy sources and reduce dependence on traditional oil and gas suppliers, the demand for LNG is expected to rise. In 2025, geopolitical tensions in key energy-producing regions may lead to increased investments in LNG infrastructure and carriers, as nations prioritize energy security. The strategic positioning of LNG carriers allows for flexible supply routes, enabling countries to respond swiftly to changing geopolitical landscapes. This adaptability is likely to enhance the attractiveness of LNG as a reliable energy source, further driving the market. Additionally, partnerships and trade agreements focused on LNG are expected to proliferate, fostering a more interconnected energy landscape.

Technological Innovations in LNG Carriers

Technological innovations play a vital role in shaping the Liquefied Natural Gas (LNG) Carrier Market. Advances in ship design, propulsion systems, and cargo handling technologies are enhancing the efficiency and safety of LNG transportation. For instance, the introduction of membrane tank systems has improved the storage capacity and reduced boil-off gas, thereby increasing the operational efficiency of LNG carriers. In 2025, it is anticipated that the adoption of dual-fuel engines, which can operate on both LNG and traditional fuels, will become more prevalent, further reducing emissions and operational costs. These technological advancements not only improve the economic viability of LNG carriers but also align with the industry's sustainability goals, making them a key driver in the market.

Increasing Demand for Cleaner Energy Sources

The transition towards cleaner energy sources is a pivotal driver for the Liquefied Natural Gas (LNG) Carrier Market. As nations strive to reduce carbon emissions, the demand for LNG, which emits significantly less CO2 compared to coal and oil, is on the rise. In 2025, the LNG market is projected to witness a growth rate of approximately 5.5%, driven by the increasing adoption of natural gas in power generation and industrial applications. This shift not only aligns with global climate goals but also enhances energy security, making LNG carriers essential for transporting this cleaner fuel. The growing emphasis on sustainability and environmental responsibility is likely to further bolster the LNG carrier market, as countries invest in infrastructure to support LNG imports and exports.