Technological Innovations

Technological innovations in the design and operation of floating liquefied natural gas terminals are driving advancements in the Floating Liquefied Natural Gas Terminals Market. Innovations such as improved liquefaction processes, enhanced safety measures, and advanced monitoring systems are making floating terminals more efficient and reliable. For instance, the integration of digital technologies and automation is streamlining operations, reducing downtime, and enhancing safety protocols. These advancements not only improve operational efficiency but also attract investment from energy companies looking to modernize their infrastructure. As technology continues to evolve, the Floating Liquefied Natural Gas Terminals Market is likely to see increased adoption of these innovative solutions, further solidifying its position in the energy sector.

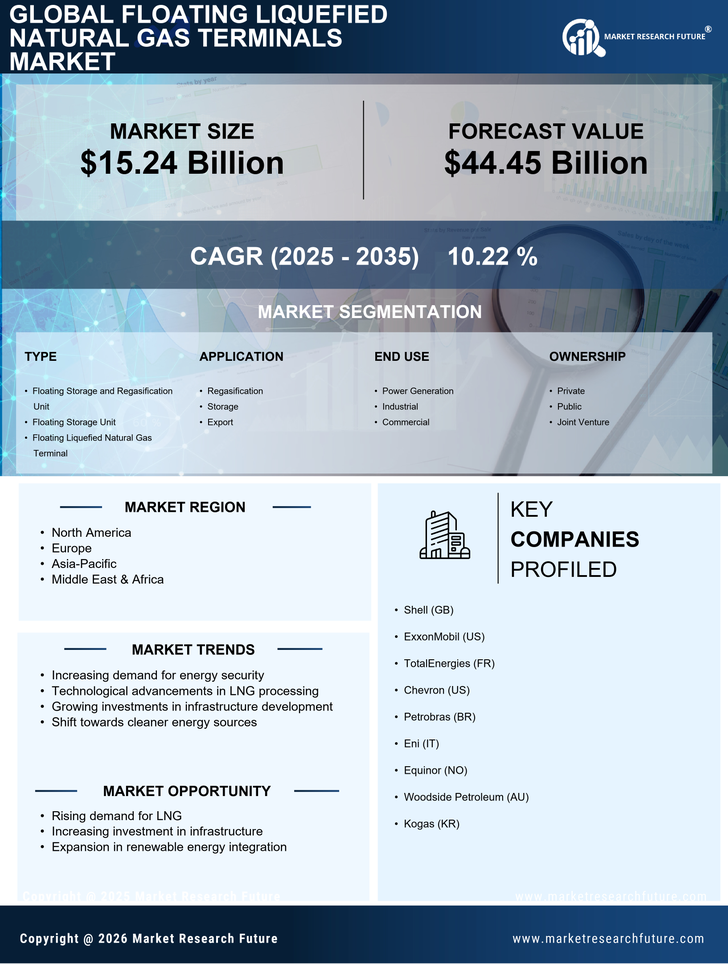

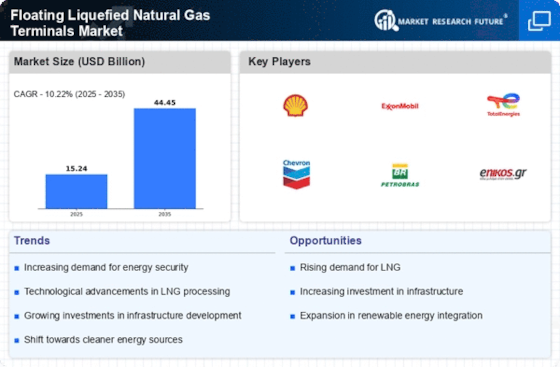

Increasing Demand for Natural Gas

The rising demand for natural gas as a cleaner alternative to coal and oil is a primary driver for the Floating Liquefied Natural Gas Terminals Market. As countries strive to reduce carbon emissions and transition to more sustainable energy sources, natural gas is increasingly viewed as a bridge fuel. According to recent data, the demand for natural gas is projected to grow by approximately 1.5% annually over the next decade. This trend is likely to stimulate investments in floating liquefied natural gas terminals, which offer flexibility and efficiency in meeting energy needs. The Floating Liquefied Natural Gas Terminals Market is thus positioned to benefit from this shift, as these terminals facilitate the rapid deployment of natural gas infrastructure in regions lacking traditional facilities.

Cost-Effectiveness of Floating Terminals

The cost-effectiveness of floating liquefied natural gas terminals compared to traditional land-based facilities is a significant driver for the Floating Liquefied Natural Gas Terminals Market. Floating terminals require lower capital investment and can be deployed more rapidly, which is particularly advantageous in regions with urgent energy needs. Recent analyses indicate that floating terminals can reduce overall project costs by up to 30% compared to onshore facilities. This economic advantage is likely to attract more stakeholders to invest in floating liquefied natural gas terminals, thereby expanding the market. As energy companies seek to optimize their operations and minimize expenditures, the Floating Liquefied Natural Gas Terminals Market is expected to experience robust growth.

Geopolitical Factors and Energy Security

Geopolitical factors and the need for energy security are driving the growth of the Floating Liquefied Natural Gas Terminals Market. As nations seek to diversify their energy sources and reduce dependence on a single supplier, floating liquefied natural gas terminals offer a strategic solution. These terminals can be deployed in various locations, allowing countries to import natural gas from multiple sources, thereby enhancing energy security. Recent geopolitical tensions have underscored the importance of having flexible and resilient energy infrastructure. Consequently, the Floating Liquefied Natural Gas Terminals Market is likely to see increased interest from governments and private entities aiming to bolster their energy independence and security.

Regulatory Support and Policy Frameworks

Regulatory support and favorable policy frameworks are crucial drivers for the Floating Liquefied Natural Gas Terminals Market. Governments worldwide are increasingly recognizing the importance of natural gas in achieving energy security and environmental goals. Policies that promote the development of liquefied natural gas infrastructure, including floating terminals, are being implemented to facilitate this transition. For example, incentives for investment in cleaner energy technologies and streamlined permitting processes are encouraging the establishment of floating terminals. This supportive regulatory environment is likely to enhance the attractiveness of the Floating Liquefied Natural Gas Terminals Market, as it provides a stable foundation for investment and development.