Rising Operational Costs

In the context of the asset performance-management market, rising operational costs in France are a significant driver. Companies are facing increased expenses related to maintenance, energy consumption, and labor. As a result, organizations are seeking innovative solutions to optimize asset performance and reduce costs. The implementation of asset performance-management systems can lead to improved efficiency, reduced downtime, and lower maintenance costs. In 2025, it is estimated that organizations could save up to 20% on operational costs by leveraging these systems. This financial incentive is likely to propel the adoption of asset performance-management solutions across various sectors in France.

Regulatory Compliance Pressure

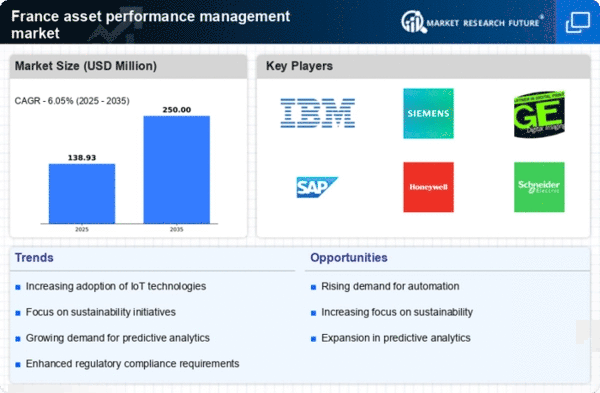

The asset performance-management market in France is increasingly influenced by stringent regulatory frameworks. The French government has implemented various regulations aimed at enhancing operational efficiency and sustainability across industries. Compliance with these regulations often necessitates the adoption of advanced asset performance-management solutions. Companies are compelled to invest in technologies that ensure adherence to environmental standards and operational guidelines. This regulatory pressure is expected to drive market growth, as organizations seek to avoid penalties and enhance their reputations. In 2025, the market is projected to grow by approximately 15% due to these compliance requirements, indicating a strong correlation between regulatory frameworks and the adoption of asset performance-management solutions.

Growing Focus on Asset Lifespan Optimization

The asset performance management market in France is increasingly focused on optimizing asset lifespan. Organizations are increasingly aware of the importance of maximizing the value derived from their assets. This trend is driving the adoption of asset performance-management solutions that provide insights into asset health and performance. By implementing these systems, companies can extend the lifespan of their assets, reduce replacement costs, and improve overall operational efficiency. In 2025, it is anticipated that the market will grow by 10% as organizations prioritize strategies aimed at asset longevity and sustainability.

Technological Advancements in Data Analytics

Technological advancements in data analytics are reshaping the asset performance-management market in France. The integration of sophisticated analytics tools enables organizations to gain deeper insights into asset performance, leading to more informed decision-making. These tools facilitate predictive maintenance, allowing companies to anticipate failures and optimize asset utilization. As organizations increasingly recognize the value of data-driven strategies, the demand for advanced asset performance-management solutions is expected to rise. In 2025, the market is projected to expand by 12% as companies invest in analytics capabilities to enhance their asset management practices.

Increased Investment in Digital Transformation

In France, the asset performance-management market is benefiting from increased investment in digital transformation initiatives. Organizations are recognizing the need to modernize their operations and leverage digital technologies to enhance asset management. This shift towards digitalization is driving the adoption of asset performance-management solutions that integrate IoT, AI, and machine learning. As companies seek to improve their operational efficiency and competitiveness, the market is expected to grow by 18% in 2025. This trend indicates a strong alignment between digital transformation efforts and the adoption of asset performance-management systems.