Increased Investment in R&D

Investment in research and development (R&D) within the automated optical-inspection-system market is a critical driver of innovation and growth in France. Companies are increasingly allocating resources to develop cutting-edge technologies that enhance inspection capabilities and improve operational efficiency. In 2025, R&D spending in the manufacturing sector is projected to increase by 12%, reflecting a strong commitment to technological advancement. This focus on innovation enables the development of systems that can adapt to various manufacturing processes and materials, thereby broadening their applicability. Additionally, advancements in artificial intelligence and machine learning are likely to enhance the analytical capabilities of these systems, allowing for more accurate defect detection. As a result, the automated optical-inspection-system market is expected to benefit from a continuous influx of innovative solutions that meet the evolving needs of manufacturers.

Growing Focus on Sustainability

the automated optical inspection system market is increasingly influenced by the growing focus on sustainability and environmental responsibility. Manufacturers are under pressure to adopt practices that minimize waste and reduce their carbon footprint. Automated optical inspection systems contribute to this goal by ensuring that products meet quality standards, thereby reducing the likelihood of rework and waste. In 2025, it is estimated that companies implementing sustainable practices could see a reduction in operational costs by up to 15%. This shift towards sustainability not only aligns with regulatory requirements but also enhances brand reputation among environmentally conscious consumers. As the demand for sustainable manufacturing practices continues to rise, the automated optical-inspection-system market is likely to expand, driven by the need for efficient and eco-friendly inspection solutions.

Expansion of the Electronics Sector

the automated optical inspection system market is significantly influenced by the expansion of the electronics sector. With the increasing complexity of electronic components and the demand for miniaturization, manufacturers are compelled to adopt advanced inspection technologies. The market for electronic devices is expected to reach €50 billion by 2026, creating a substantial opportunity for automated optical inspection systems. These systems facilitate the detection of minute defects that could compromise functionality, thereby ensuring the reliability of electronic products. Furthermore, the integration of automation in production lines enhances efficiency and reduces labor costs, making it an attractive investment for manufacturers. As the electronics sector continues to evolve, the automated optical-inspection-system market is likely to witness sustained growth, driven by the need for precision and quality assurance.

Rising Demand for Quality Assurance

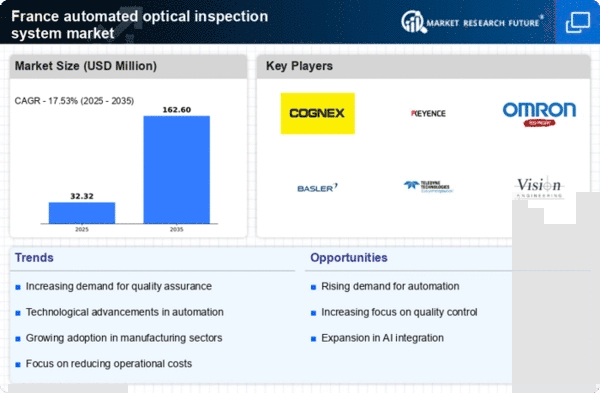

the automated optical inspection system market experiences a notable surge in demand driven by the increasing emphasis on quality assurance across various industries. As manufacturers strive to enhance product reliability and minimize defects, the adoption of automated optical inspection systems becomes essential. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the industry's commitment to maintaining high standards. This trend is particularly evident in sectors such as electronics and automotive, where precision is paramount. The integration of advanced imaging technologies and machine learning algorithms further enhances the capabilities of these systems, allowing for real-time defect detection and analysis. Consequently, the automated optical-inspection-system market is positioned to play a pivotal role in ensuring product integrity and compliance with stringent quality regulations.

Integration of Industry 4.0 Technologies

The integration of Industry 4.0 technologies is a significant driver for the automated optical-inspection-system market in France. As manufacturers increasingly adopt smart manufacturing practices, the demand for advanced inspection systems that can seamlessly integrate with IoT devices and data analytics platforms is on the rise. This trend is expected to propel the market forward, with projections indicating a growth rate of 10% annually through 2027. The ability to collect and analyze data in real-time enhances decision-making processes and operational efficiency. Furthermore, the implementation of connected systems allows for predictive maintenance, reducing downtime and improving overall productivity. As Industry 4.0 continues to reshape the manufacturing landscape, the automated optical-inspection-system market is poised to benefit from the growing need for interconnected and intelligent inspection solutions.