Consumer Demand for Sustainability

There is a growing consumer demand for sustainable automotive solutions in France, which is shaping the automotive exhaust gas recirculation market. French consumers are increasingly aware of environmental issues and are favoring vehicles that demonstrate lower emissions and better fuel efficiency. This shift in consumer preferences is prompting manufacturers to enhance their EGR systems, as these technologies play a crucial role in reducing harmful emissions. Market data indicates that sales of eco-friendly vehicles, including those equipped with advanced EGR systems, have surged by over 30% in the past year. This trend suggests that the France automotive exhaust gas recirculation market must adapt to meet the evolving expectations of environmentally conscious consumers.

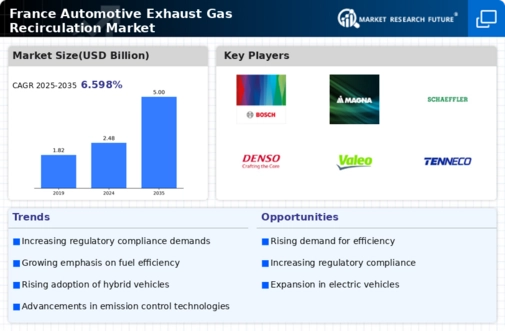

Regulatory Compliance and Innovation

The France automotive exhaust gas recirculation market is significantly influenced by stringent regulatory frameworks aimed at reducing vehicular emissions. The French government has implemented various policies, including the Euro 6 standards, which mandate lower nitrogen oxide emissions from vehicles. This regulatory environment compels manufacturers to innovate and adopt advanced exhaust gas recirculation technologies. As of 2025, approximately 80% of new vehicles in France are expected to comply with these standards, driving the demand for efficient EGR systems. Furthermore, the government's commitment to achieving carbon neutrality by 2050 reinforces the need for continuous innovation in the automotive sector, thereby propelling the growth of the France automotive exhaust gas recirculation market.

Technological Advancements in EGR Systems

Technological advancements in exhaust gas recirculation systems are driving the evolution of the France automotive exhaust gas recirculation market. Innovations such as variable geometry EGR valves and advanced control algorithms are enhancing the performance and efficiency of EGR systems. These advancements enable better management of exhaust gases, leading to improved fuel economy and reduced emissions. As of 2025, it is estimated that the adoption of these advanced EGR technologies will increase by 40% among new vehicle models in France. This trend indicates a strong focus on research and development within the automotive sector, positioning the France automotive exhaust gas recirculation market for substantial growth.

Government Incentives for Clean Technology

Government incentives aimed at promoting clean technology are playing a crucial role in shaping the France automotive exhaust gas recirculation market. The French government has introduced various financial incentives, such as tax rebates and subsidies, to encourage manufacturers to invest in cleaner technologies, including advanced EGR systems. These incentives are designed to accelerate the transition towards low-emission vehicles, with a target of having 1 million electric vehicles on the road by 2025. As a result, the France automotive exhaust gas recirculation market is likely to experience increased investment and innovation, as manufacturers seek to capitalize on these opportunities and align with national sustainability goals.

Integration with Hybrid and Electric Vehicles

The integration of exhaust gas recirculation systems with hybrid and electric vehicles is emerging as a pivotal driver in the France automotive exhaust gas recirculation market. As the automotive landscape shifts towards electrification, manufacturers are exploring innovative ways to incorporate EGR technologies into hybrid models to enhance efficiency and reduce emissions. In 2025, it is projected that hybrid vehicles will account for nearly 25% of new car sales in France, necessitating the development of compatible EGR systems. This integration not only supports compliance with stringent emission regulations but also aligns with consumer preferences for greener alternatives, thereby fostering growth in the France automotive exhaust gas recirculation market.