Technological Advancements

Technological advancements play a crucial role in shaping the France biogas market. Innovations in anaerobic digestion technology, for instance, have improved the efficiency of biogas production from organic waste. The introduction of advanced monitoring systems and automation in biogas plants has led to enhanced operational efficiency and reduced costs. In 2025, the average biogas yield in France has increased by 15% compared to previous years, largely due to these technological improvements. Additionally, research and development initiatives funded by the government and private sector are fostering the emergence of new technologies that could further optimize biogas production processes. This continuous evolution in technology is likely to drive the growth of the France biogas market, making it more competitive and sustainable.

Increased Feedstock Utilization

The France biogas market is witnessing a significant increase in feedstock utilization, which is essential for enhancing biogas production. Various organic materials, including agricultural residues, food waste, and livestock manure, are being increasingly utilized as feedstock for biogas plants. In 2025, it is estimated that over 60% of biogas production in France is derived from agricultural waste, reflecting a shift towards more sustainable practices. This trend not only maximizes resource efficiency but also contributes to waste reduction and environmental sustainability. Moreover, the French government encourages the use of diverse feedstocks through financial incentives, which further stimulates the growth of the biogas sector. As feedstock availability continues to expand, the France biogas market is likely to experience enhanced production capabilities and economic viability.

Public Awareness and Acceptance

Public awareness and acceptance of biogas as a renewable energy source are increasingly influencing the France biogas market. Educational campaigns and community engagement initiatives have been implemented to inform the public about the benefits of biogas, including its role in reducing greenhouse gas emissions and promoting energy independence. As of 2025, surveys indicate that approximately 70% of the French population supports the development of biogas projects, reflecting a growing recognition of its environmental advantages. This heightened awareness is likely to facilitate the establishment of new biogas facilities and foster collaboration between stakeholders, including local communities and government entities. Consequently, public acceptance is becoming a vital driver for the expansion of the France biogas market, as it encourages investment and participation in renewable energy initiatives.

Regulatory Support and Incentives

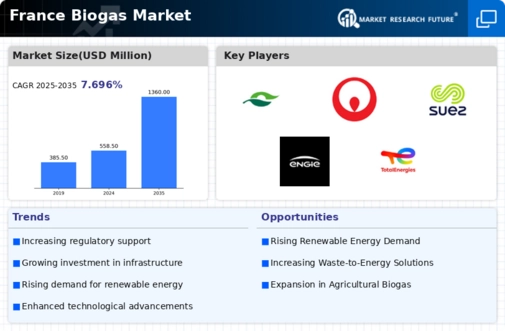

The France biogas market benefits from robust regulatory frameworks and incentives that promote the development of biogas projects. The French government has established various policies aimed at increasing renewable energy production, including biogas. For instance, the Energy Transition for Green Growth Act encourages investments in biogas facilities through feed-in tariffs and subsidies. As of 2025, the biogas production capacity in France reached approximately 1,200 MW, indicating a growing trend supported by these regulations. Furthermore, the European Union's Renewable Energy Directive sets ambitious targets for renewable energy, further bolstering the France biogas market. This regulatory environment not only enhances investor confidence but also stimulates innovation and growth within the sector.

Investment Opportunities and Economic Growth

Investment opportunities in the France biogas market are expanding, driven by the increasing demand for renewable energy solutions. The French government has set ambitious targets for renewable energy production, aiming for 32% of total energy consumption to come from renewable sources by 2030. This goal presents significant investment potential for biogas projects, attracting both domestic and international investors. In 2025, the total investment in the biogas sector is projected to exceed 1 billion euros, reflecting a growing confidence in the market's future. Additionally, the development of biogas facilities contributes to local economic growth by creating jobs and supporting rural development. As investment continues to flow into the France biogas market, it is likely to stimulate innovation, enhance production capacity, and contribute to the overall energy transition.