Growing Coffee Culture

The evolving coffee culture in France appears to be a significant driver for the capsule coffee-machine market. As consumers increasingly seek high-quality coffee experiences at home, the demand for convenient brewing solutions rises. Recent data indicates that approximately 60% of French households own a coffee machine, with a notable shift towards capsule systems. This trend suggests that consumers are willing to invest in premium products that offer both quality and convenience. The capsule coffee-machine market is likely to benefit from this cultural shift, as more individuals prioritize gourmet coffee experiences without the need for extensive barista skills.

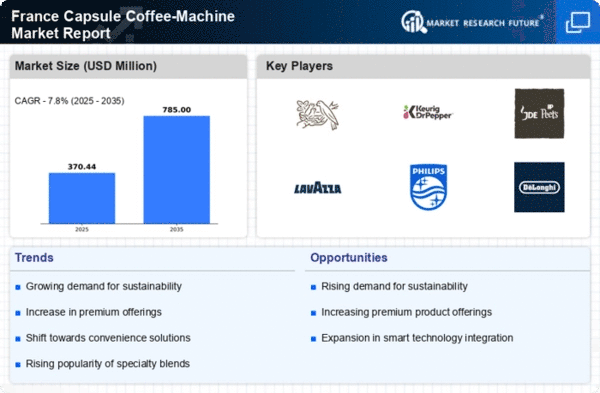

Sustainability Concerns

Sustainability has emerged as a pivotal concern among French consumers, influencing their purchasing decisions in the capsule coffee-machine market. With growing awareness of environmental issues, many consumers are seeking eco-friendly options. Recent surveys indicate that approximately 40% of consumers are willing to pay a premium for sustainable products. This shift suggests that manufacturers in the capsule coffee-machine market may need to adapt by offering recyclable or biodegradable capsules. As sustainability becomes a priority, the market could see a rise in demand for products that align with eco-conscious values, potentially reshaping consumer preferences.

Diverse Flavor Offerings

The increasing variety of coffee flavors and blends available in capsule form is another compelling driver for the capsule coffee-machine market. French consumers are known for their discerning taste, and the availability of diverse options caters to this preference. Recent statistics reveal that over 50% of capsule coffee-machine users experiment with different flavors regularly. This trend suggests that the market is evolving to meet consumer demands for unique and personalized coffee experiences. As brands expand their offerings, the potential for growth in the capsule coffee-machine market appears promising, with consumers eager to explore new taste profiles.

Technological Integration

The integration of advanced technology into coffee machines is reshaping the landscape of the capsule coffee-machine market. Features such as smart connectivity and customizable brewing settings are becoming increasingly popular among tech-savvy consumers. Data indicates that around 30% of new coffee machine purchases in France include smart features. This trend suggests that the market is evolving to meet the expectations of a digitally connected consumer base. As technology continues to advance, the potential for innovation in the capsule coffee-machine market appears vast, with opportunities for enhanced user experiences and product differentiation.

Convenience and Time Efficiency

In the fast-paced lifestyle of modern France, convenience plays a crucial role in consumer choices, particularly in the capsule coffee-machine market. The ability to brew a fresh cup of coffee in under a minute appeals to busy professionals and families alike. Market analysis shows that around 70% of consumers prefer capsule machines for their speed and ease of use. This preference indicates a strong inclination towards products that save time while delivering quality. As the capsule coffee-machine market continues to innovate, the focus on user-friendly designs and quick brewing capabilities is likely to enhance its appeal further.