Expansion of Biotechnology Research

The biotechnology sector in France is witnessing significant expansion, which is likely to drive the chromatography columns market. With a growing emphasis on biopharmaceuticals and personalized medicine, there is an increasing need for advanced separation techniques. Chromatography columns are essential for the purification and analysis of biomolecules, such as proteins and nucleic acids. The market is expected to see a growth rate of around 7% annually, reflecting the rising investments in biotechnology research. This trend suggests that as more biotech firms emerge and existing companies expand their capabilities, the demand for high-quality chromatography columns will continue to rise, further solidifying the industry's position in the market.

Growing Academic Research Initiatives

The academic research landscape in France is expanding, which is likely to impact the chromatography columns market positively. Universities and research institutions are increasingly investing in advanced analytical equipment to support various scientific studies. This growth is reflected in the rising number of research publications and projects that require chromatography techniques for analysis. The market is expected to grow by approximately 4.5% annually, as educational institutions prioritize the acquisition of high-quality chromatography columns for their laboratories. This trend indicates that the demand for chromatography columns will be sustained by the ongoing commitment to research and innovation in academic settings.

Rising Demand in Pharmaceutical Sector

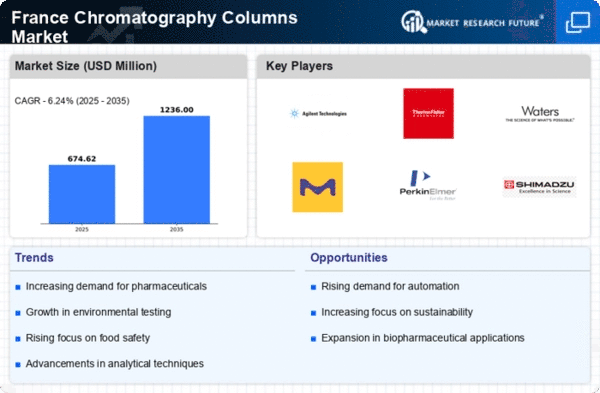

The pharmaceutical sector in France is experiencing a notable increase in demand for chromatography columns, driven by the need for efficient drug development and quality control processes. As the industry focuses on ensuring the purity and efficacy of pharmaceutical products, chromatography columns play a crucial role in analytical testing. The market for chromatography columns in this sector is projected to grow at a CAGR of approximately 6.5% over the next five years. This growth is indicative of the increasing reliance on advanced analytical techniques to meet stringent regulatory standards. Consequently, the chromatography columns market is likely to benefit from this upward trend, as pharmaceutical companies invest in state-of-the-art equipment to enhance their research and development capabilities.

Increased Focus on Environmental Testing

In France, there is a heightened focus on environmental testing, which is influencing the chromatography columns market. Regulatory bodies are enforcing stricter environmental standards, necessitating the analysis of pollutants and contaminants in various matrices. Chromatography columns are vital for these analytical processes, enabling accurate detection and quantification of harmful substances. The market for chromatography columns in environmental applications is projected to grow by approximately 5% annually, driven by the need for compliance with environmental regulations. This trend indicates that laboratories and testing facilities are likely to invest in advanced chromatography technologies, thereby enhancing the overall demand within the chromatography columns market.

Technological Innovations in Chromatography

Technological innovations are reshaping the chromatography columns market in France. The introduction of new materials and designs, such as monolithic columns and nano-scale chromatography, is enhancing the efficiency and effectiveness of separation processes. These advancements are particularly relevant in high-throughput laboratories, where speed and accuracy are paramount. The market is anticipated to grow at a rate of 6% per year, as researchers and analysts seek to adopt cutting-edge technologies to improve their workflows. This trend suggests that the chromatography columns market will continue to evolve, driven by the need for more sophisticated analytical solutions that meet the demands of modern research.