Increasing Oral Health Awareness

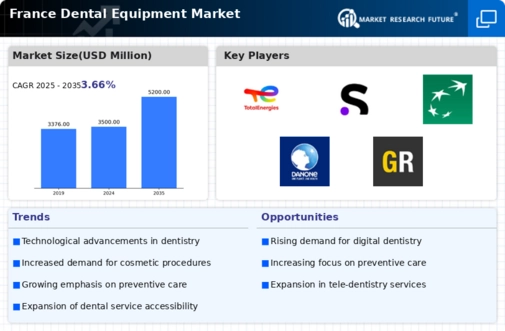

The dental equipment market in France is experiencing growth due to a heightened awareness of oral health among the population. Educational campaigns and initiatives by health authorities have led to a greater understanding of the importance of dental hygiene. This awareness is reflected in the rising demand for dental check-ups and preventive care, which in turn drives the need for advanced dental equipment. According to recent data, the market is projected to grow at a CAGR of 5.2% over the next five years, indicating a robust expansion. As consumers become more proactive about their oral health, dental professionals are investing in state-of-the-art equipment to meet this demand, thereby enhancing the overall quality of care provided in the dental equipment market.

Rising Cosmetic Dentistry Trends

The rising popularity of cosmetic dentistry significantly influences the dental equipment market in France. As more individuals seek aesthetic enhancements, dental practices are investing in specialized equipment to offer a range of cosmetic procedures. This trend is driven by a cultural shift towards valuing appearance and self-esteem, leading to a surge in demand for services such as teeth whitening, veneers, and orthodontics. The market for cosmetic dental equipment is expected to grow by approximately 6% annually, reflecting the rising consumer interest in aesthetic dental solutions. As dental professionals respond to this demand, the dental equipment market is likely to see continued innovation and expansion.

Government Initiatives and Regulations

Government policies and regulations play a crucial role in shaping the dental equipment market in France. The French government has implemented various initiatives aimed at improving dental care accessibility and quality. For instance, subsidies for dental practices to upgrade their equipment have been introduced, which encourages practitioners to invest in modern technologies. Additionally, regulations regarding sterilization and safety standards necessitate the use of advanced dental equipment. These factors contribute to a more competitive landscape, as dental professionals strive to comply with regulations while enhancing patient care. The dental equipment market is likely to benefit from these initiatives, as they promote innovation and investment in new technologies.

Aging Population and Increased Dental Needs

France's aging population is contributing to the growth of the dental equipment market. As individuals age, they often experience a higher incidence of dental issues, necessitating more frequent dental visits and treatments. This demographic shift is prompting dental practices to expand their services and invest in advanced equipment to cater to the specific needs of older patients. The market is projected to see a rise in demand for restorative and prosthetic dental equipment, which is essential for treating age-related dental conditions. Consequently, the dental equipment market is likely to expand as practitioners adapt to the evolving needs of an aging population.

Technological Integration in Dental Practices

Integrating technology into dental practices is a significant driver of the dental equipment market in France. Innovations such as digital imaging, CAD/CAM systems, and tele-dentistry are transforming how dental services are delivered. These technologies not only improve diagnostic accuracy but also enhance patient experience and treatment outcomes. The market for digital dental equipment is expected to grow substantially, with estimates suggesting an increase of 7% annually. As dental professionals adopt these technologies, the demand for sophisticated equipment rises, thereby propelling the dental equipment market forward. This trend indicates a shift towards more efficient and patient-centered care in the dental sector.

Leave a Comment