Public-Private Partnerships

Public-private partnerships (PPPs) are emerging as a vital driver for the France electric vehicle charging infrastructure market. Collaborations between government entities and private companies are facilitating the development and expansion of charging networks across the country. These partnerships leverage the strengths of both sectors, combining public funding with private expertise and innovation. For example, several cities in France are engaging in PPPs to deploy charging stations in urban areas, which is expected to enhance accessibility for EV users. This collaborative approach is likely to accelerate the growth of the France electric vehicle charging infrastructure market.

Growing Electric Vehicle Adoption

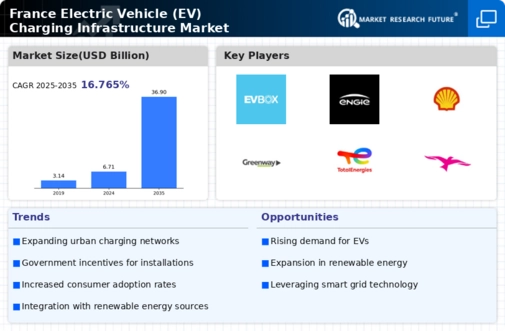

The increasing adoption of electric vehicles (EVs) in France is a primary driver for the electric vehicle charging infrastructure market. As of 2025, the number of registered electric vehicles in France has surpassed 1.5 million, reflecting a growing consumer preference for sustainable transportation. This surge in EV adoption necessitates a corresponding expansion of charging infrastructure to meet the demand for convenient and accessible charging solutions. The French government aims to support this growth by enhancing the charging network, which is likely to create new opportunities for stakeholders in the France electric vehicle charging infrastructure market.

Government Incentives and Policies

The France electric vehicle charging infrastructure market is significantly influenced by government incentives and policies aimed at promoting electric vehicle adoption. The French government has implemented various initiatives, such as the 'Bonus Ecologique' program, which provides financial incentives for purchasing electric vehicles. Additionally, the government has set ambitious targets to install 100,000 public charging points by 2025, which is expected to enhance the charging infrastructure. These policies not only encourage consumers to switch to electric vehicles but also stimulate investments in charging infrastructure, thereby fostering growth in the France electric vehicle charging infrastructure market.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are playing a pivotal role in shaping the France electric vehicle charging infrastructure market. Many companies are committing to reducing their carbon footprints by transitioning their fleets to electric vehicles. This shift is driving demand for charging stations at corporate facilities and public locations. For instance, major corporations in France are investing in the installation of charging points to support their electric vehicle fleets, which is expected to contribute to the overall growth of the charging infrastructure. As businesses prioritize sustainability, the France electric vehicle charging infrastructure market is likely to experience increased investments and developments.

Technological Innovations in Charging Solutions

Technological innovations are transforming the France electric vehicle charging infrastructure market by enhancing the efficiency and convenience of charging solutions. Developments in fast-charging technology, such as ultra-fast chargers, are enabling quicker charging times, which is crucial for user convenience. Furthermore, advancements in smart charging systems allow for better energy management and integration with renewable energy sources. These innovations not only improve the user experience but also attract investments in charging infrastructure, thereby driving growth in the France electric vehicle charging infrastructure market.