Advancements in Medical Imaging Technologies

Innovations in medical imaging technologies are significantly influencing the endoscopic ultrasound-needles market. The integration of high-definition imaging and real-time visualization capabilities enhances the accuracy of diagnoses and procedures. Recent developments in ultrasound technology, such as elastography and contrast-enhanced ultrasound, have improved the ability to detect and characterize lesions. This technological evolution is expected to drive market growth, as healthcare facilities in France increasingly adopt these advanced imaging modalities. The endoscopic ultrasound-needles market stands to benefit from these advancements, as they facilitate more effective interventions and improve patient safety. As a result, the market is projected to witness a compound annual growth rate (CAGR) of around 8% over the next five years.

Growing Focus on Patient Safety and Outcomes

The emphasis on patient safety and improved clinical outcomes is a significant driver for the endoscopic ultrasound-needles market. Healthcare providers in France are increasingly prioritizing minimally invasive techniques that reduce patient recovery time and complications. Endoscopic ultrasound-needles are designed to minimize trauma and enhance precision during procedures, aligning with this focus. As hospitals and clinics adopt protocols that prioritize patient-centered care, the demand for these specialized needles is likely to rise. Furthermore, studies indicate that the use of endoscopic ultrasound-needles can lead to a reduction in post-procedural complications by up to 20%, further solidifying their role in modern medical practice. This trend is expected to propel the market forward as healthcare systems strive for excellence in patient care.

Rising Investment in Healthcare Infrastructure

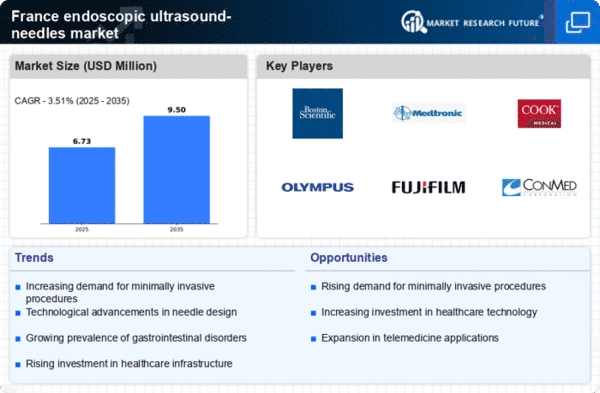

The increasing investment in healthcare infrastructure in France is a pivotal driver for the endoscopic ultrasound-needles market. Government initiatives aimed at enhancing healthcare facilities and expanding access to advanced medical technologies are likely to create a favorable environment for market growth. With substantial funding allocated to modernizing hospitals and clinics, the demand for sophisticated diagnostic tools, including endoscopic ultrasound-needles, is expected to rise. This investment trend is reflected in the projected growth of the healthcare sector, which is anticipated to reach €200 billion by 2027. As healthcare providers upgrade their capabilities, the endoscopic ultrasound-needles market is poised to benefit from this influx of resources, leading to increased adoption and utilization of these essential medical devices.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders in France is a crucial driver for the endoscopic ultrasound-needles market. Conditions such as pancreatitis, gastrointestinal cancers, and inflammatory bowel diseases are becoming more prevalent, necessitating advanced diagnostic tools. According to health statistics, the prevalence of these disorders has increased by approximately 15% over the past decade. This trend underscores the need for effective diagnostic procedures, where endoscopic ultrasound-needles play a vital role. As healthcare providers seek to enhance patient outcomes, the demand for these specialized needles is likely to grow, reflecting a shift towards more precise and less invasive diagnostic techniques. Consequently, The endoscopic ultrasound-needles market is expected to expand significantly due to the increasing demand for healthcare services.

Supportive Regulatory Environment for Medical Devices

The regulatory landscape in France is becoming increasingly supportive of innovations in medical devices, including those in the endoscopic ultrasound-needles market. Regulatory bodies are streamlining approval processes for new technologies, which encourages manufacturers to invest in research and development. This supportive environment is likely to foster the introduction of advanced endoscopic ultrasound-needles that offer enhanced features and improved performance. As a result, the market may experience a surge in new product launches, catering to the evolving needs of healthcare providers. The anticipated growth in the endoscopic ultrasound-needles market is further bolstered by the expectation that regulatory frameworks will continue to evolve, promoting innovation while ensuring patient safety.