Focus on Quality Assurance

Quality assurance remains a critical driver for the fill finish-manufacturing market in France. With the rise of complex biologics and personalized medicines, ensuring product integrity and safety has become paramount. Regulatory bodies are imposing stricter guidelines, compelling manufacturers to adopt robust quality management systems. The fill finish-manufacturing market must therefore invest in advanced quality control technologies, such as real-time monitoring and data analytics, to comply with these regulations. This focus on quality not only mitigates risks associated with product recalls but also enhances consumer trust, which is essential for market growth. As a result, companies that prioritize quality assurance are likely to gain a competitive edge in the evolving landscape.

Increasing Regulatory Scrutiny

The fill finish-manufacturing market in France is facing heightened regulatory scrutiny, which serves as a significant driver for market evolution. Regulatory agencies are intensifying their oversight of manufacturing practices to ensure product safety and efficacy. This trend necessitates that manufacturers adopt more rigorous compliance measures, including enhanced documentation and validation processes. The cost of non-compliance can be substantial, with potential fines reaching millions of euros. Consequently, companies are compelled to invest in training and technology to meet these stringent requirements. This increasing regulatory scrutiny not only impacts operational costs but also drives innovation within the fill finish-manufacturing market, as firms seek to develop more efficient and compliant manufacturing processes.

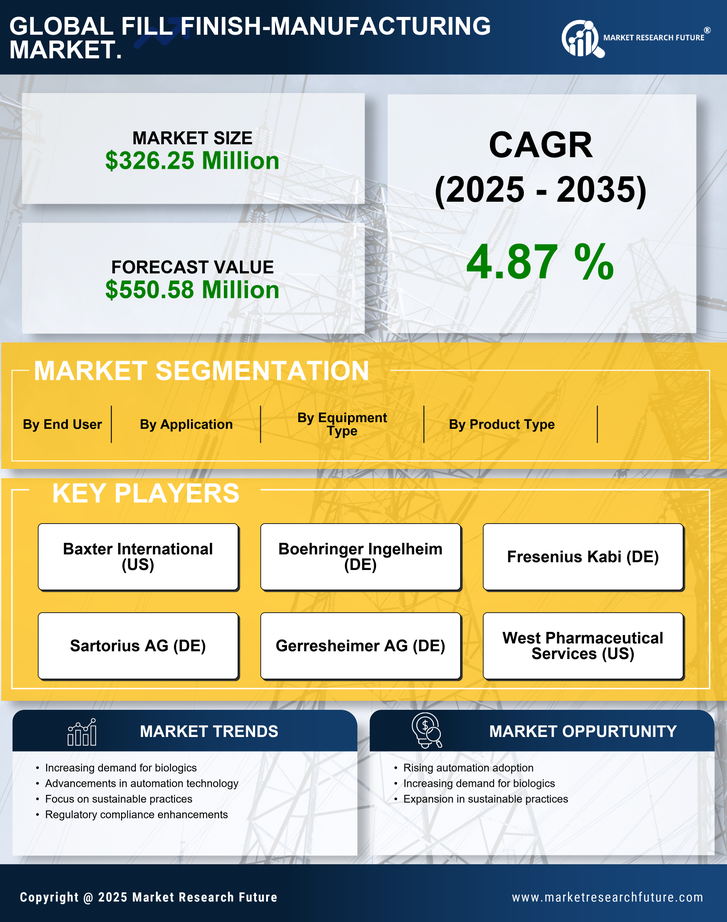

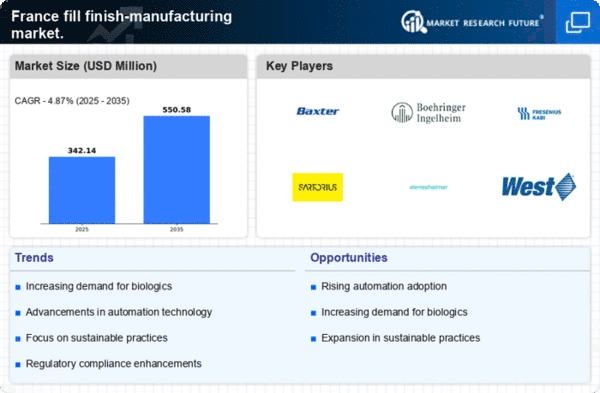

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in France is a pivotal driver for the fill finish-manufacturing market. As the healthcare sector evolves, the need for advanced therapies, including monoclonal antibodies and gene therapies, has surged. This trend is reflected in the projected growth of the biopharmaceutical market, which is expected to reach €40 billion by 2026. Consequently, fill finish-manufacturing processes must adapt to accommodate the unique requirements of these products, such as stringent sterility and stability standards. The fill finish-manufacturing market is thus positioned to benefit from this rising demand, necessitating investments in state-of-the-art facilities and technologies to ensure compliance with regulatory standards and to meet the increasing production volumes.

Investment in Automation Technologies

The fill finish-manufacturing market in France is experiencing a significant shift towards automation technologies. This trend is driven by the need for enhanced efficiency, reduced human error, and improved product quality. Automation solutions, such as robotic filling systems and advanced monitoring technologies, are being increasingly adopted to streamline operations. Reports indicate that automation can reduce production costs by up to 30%, making it a financially attractive option for manufacturers. As companies seek to optimize their processes and maintain competitiveness, the fill finish-manufacturing market is likely to see a surge in investments in automation, which could lead to faster turnaround times and increased production capacity.

Emergence of Contract Manufacturing Organizations (CMOs)

The rise of Contract Manufacturing Organizations (CMOs) is reshaping the fill finish-manufacturing market in France. As pharmaceutical companies increasingly outsource their manufacturing processes to focus on core competencies, CMOs are stepping in to provide specialized services. This trend is particularly evident in the biopharmaceutical sector, where CMOs offer expertise in handling complex fill finish operations. The market for CMOs is projected to grow at a CAGR of 10% over the next five years, indicating a robust demand for outsourced manufacturing solutions. This shift allows pharmaceutical companies to reduce capital expenditures while ensuring access to advanced technologies and skilled labor, thereby driving growth in the fill finish-manufacturing market.